Ah, spreadsheets—the familiar grid of cells, endless columns, and those VLOOKUP formulas that feel like magic when they work. For many finance teams, they’re the first step beyond old‑school paper trails in managing company expenses.

But let’s be honest: spreadsheets quickly break down as your business grows.

What starts as a simple tool becomes a tangled mess of versions, endless manual data entry, and scattered details, making it increasingly difficult to control spending, track expenses in real-time, stay compliant, and close the books on schedule.

That’s where expense automation software comes in.

It simplifies the entire expense management process, from capturing receipts and tracking budgets to generating reports. In fact, companies using expense automation save an average of 10 hours per week on manual reconciliation tasks.

In this blog post, we break down its key features, the benefits you can expect, and highlight some of the top tools in the market. We’ll also look at industry‑specific use cases and share practical tips to help you transition to an expense automation platform with confidence.

Understanding Automated Expense Management

What is expense automation software?

Simply put, expense automation software is a digital solution that enables finance teams like yours to manage and control company spending without relying on manual processes.

It enables you to capture, track, and approve expenses in real-time, providing a centralized system—delivered through mobile apps, email integrations, and web platforms—for managing employee reimbursements, vendor payments, and other financial transactions.

By automating tasks such as receipt capture, expense categorization, and approval workflows, expense automation software:

- Reduces human error

- Enforces compliance with company policies

- Ensures accurate, well‑documented records

How does expense automation software work?

At its core, expense automation software integrates various tools and technologies you already use, such as QuickBooks, Xero, or NetSuite, to make expense tracking easier.

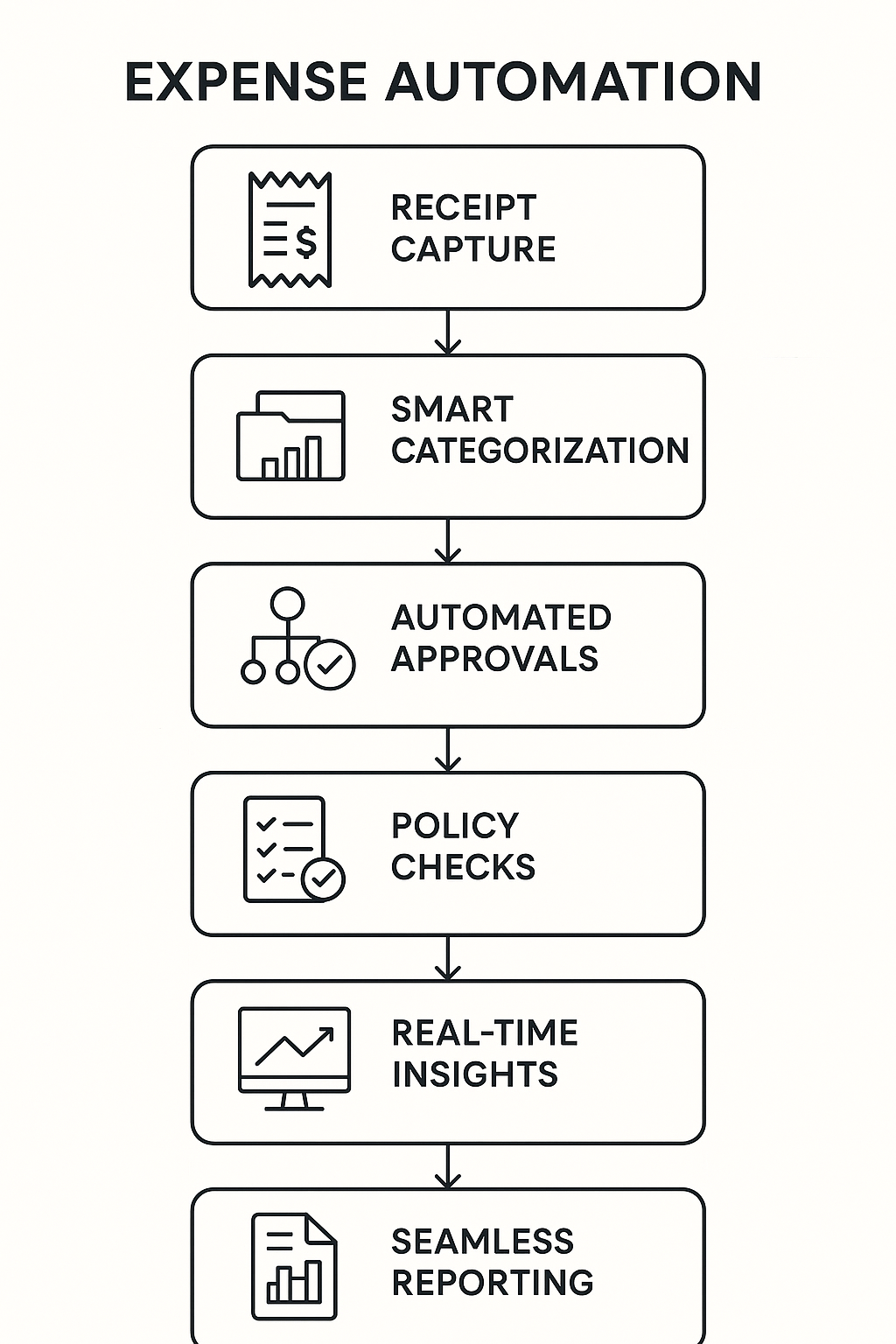

Here’s how a typical workflow unfolds:

- Employees submit receipts through a mobile app, email, or even WhatsApp; OCR (optical character recognition) technology instantly reads each receipt, pulling out key details such as the merchant, amount, and date

- The software automatically assigns each transaction to the correct department, project, or expense type based on predefined rules

- Expenses are routed to the correct manager or department head for quick approval

- Each expense is checked against company policies; if something exceeds budget limits or falls outside approved categories, it’s flagged or automatically rejected

- Finance leaders can view real‑time dashboards that show spending by department, track budget usage, and receive alerts for policy violations or overspending

- The system handles reconciliations and generates detailed financial reports

Key Features of Expense Management Tools

Now that you know what expense automation software is and how it works in practice, let’s take a closer look at the key features that make it so powerful.

1. Real-time visibility

Expense management tools provide real-time insights into all company spending. Finance teams can track and monitor expenses as they happen, which helps prevent budget overruns and allows for immediate corrective action.

With real-time visibility, you can monitor departmental spending, identify trends, and ensure budgets are adhered to without waiting for month-end reports.

2. Seamless integrations

A powerful expense automation system integrates with your existing accounting software and ERP systems, such as QuickBooks, Netsuite, or Xero. This integration eliminates the need for manual data entry, ensuring that all transactions are automatically reconciled.

For example, when an employee submits a receipt, the data is transmitted directly into your accounting system, reducing errors and streamlining financial management and reporting.

3. Enhanced security measures

With growing concerns about data privacy and financial fraud, security is a top priority for any finance team. Leading expense automation tools offer advanced security features, including end-to-end encryption, role-based access controls, and secure cloud storage.

Additionally, platforms like Pluto are PCI DSS Level 1 certified, ensuring that your company’s sensitive financial data is protected from unauthorized access and cyber threats.

Top Automated Expense Management Tools in the Market

When it comes to automating expense management, several platforms are available for selection. Here’s our list of recommendations:

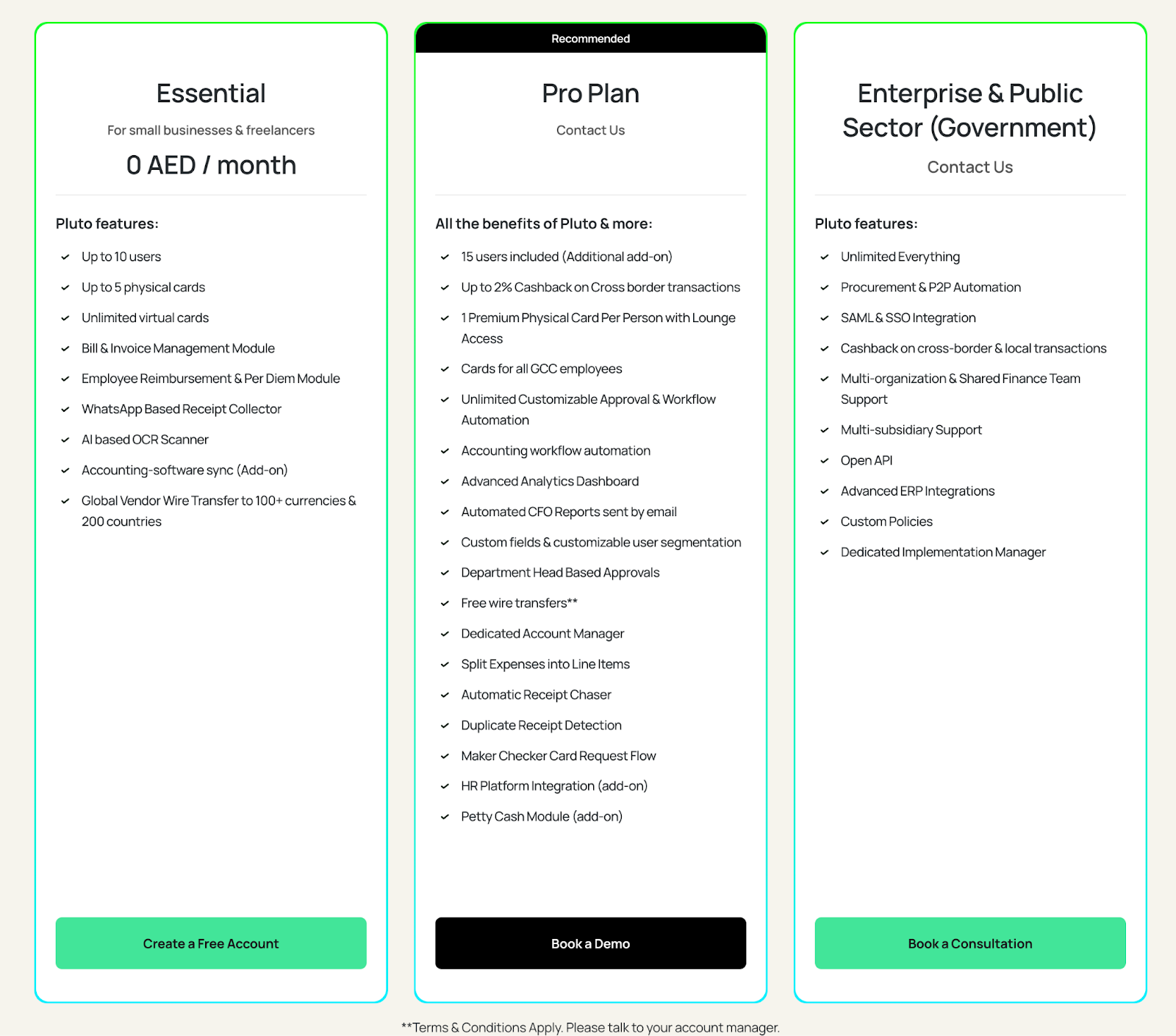

1. Pluto

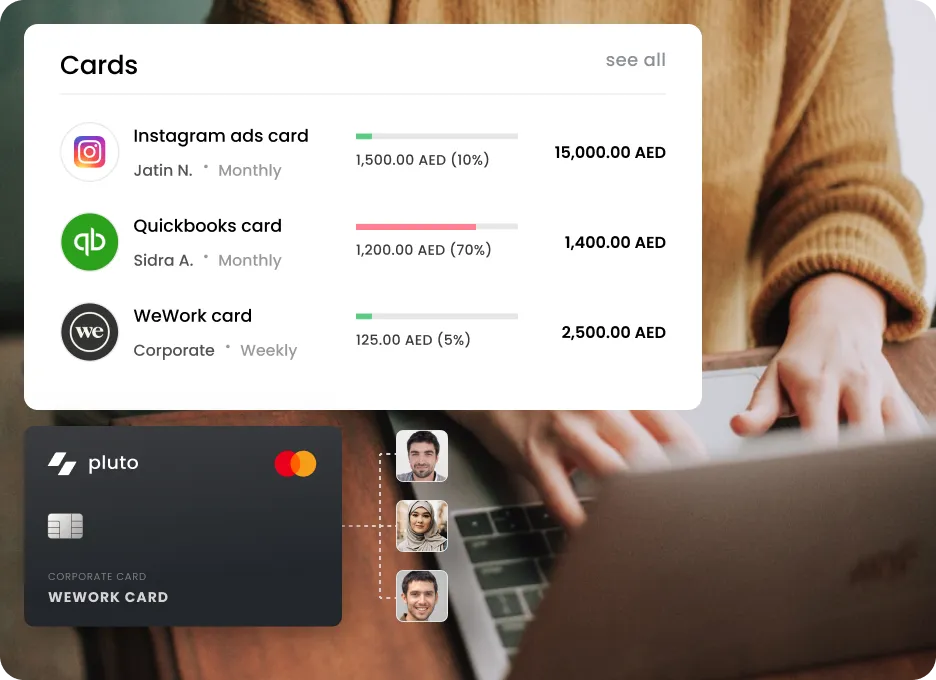

Pluto is a comprehensive expense management software that gives finance teams total transparency and control over company spending.

It unifies corporate cards, reimbursements, petty cash management, and procurement workflows into a single seamless system, trusted by some of the largest finance teams in the UAE and the US across various industries, including aviation, media, and government services.

What makes Pluto stand out is how deeply it’s built for real‑world control:

- Issue virtual or physical cards to employees, departments, or specific vendors; each card can carry unique limits or just‑in‑time funding to maintain working capital

- Automatically lock cards if receipts aren’t submitted, cutting down on admin and ensuring compliance without constant follow‑ups

- Replace cash boxes with instant card‑based petty cash management and branch‑level visibility

- Sync Pluto with QuickBooks, Xero, or NetSuite in minutes to automate reconciliation, GL coding, and tax tracking

- Dashboards and analytics show where money goes as soon as it’s spent, giving finance teams the data they need to act before month‑end

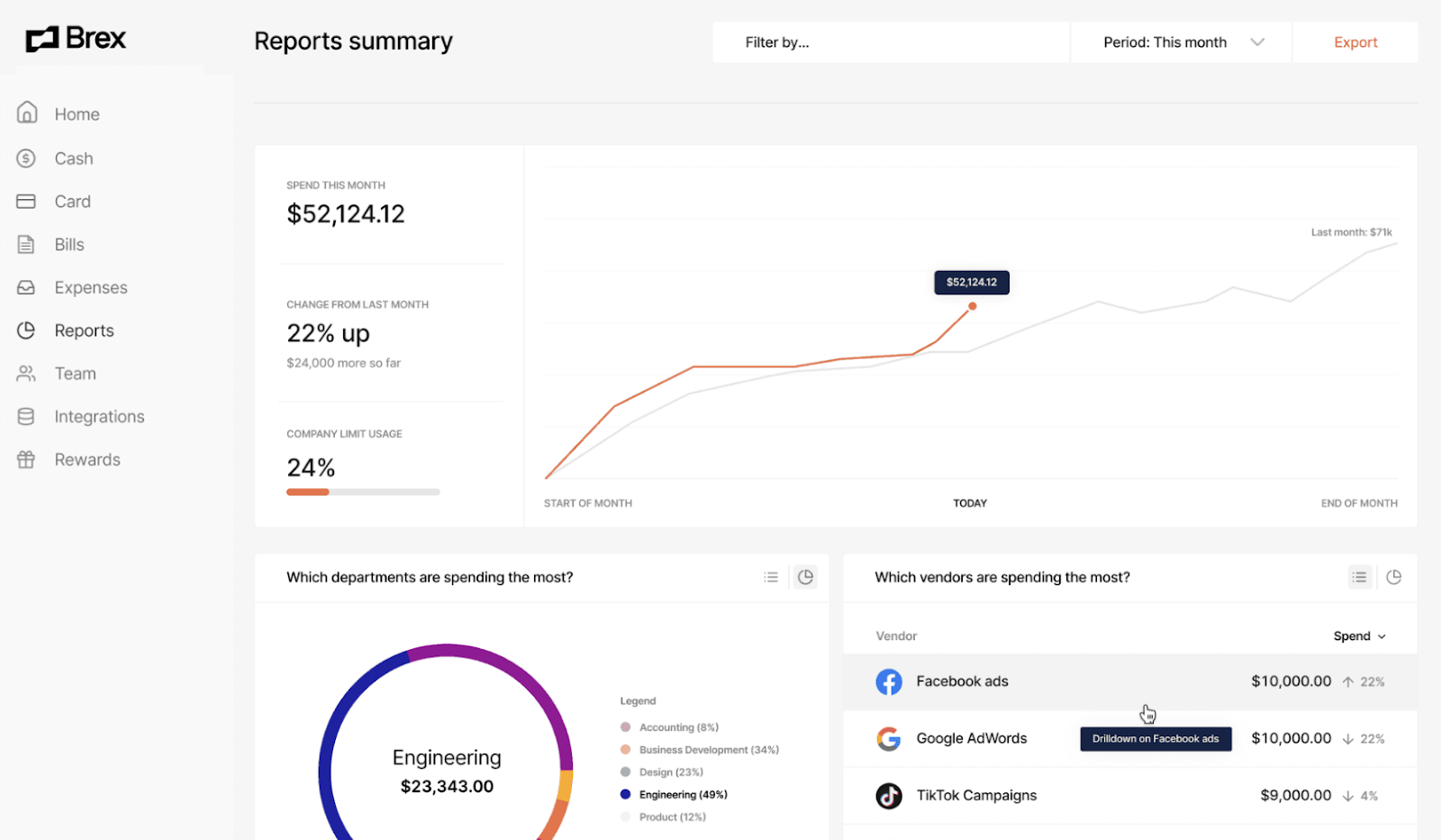

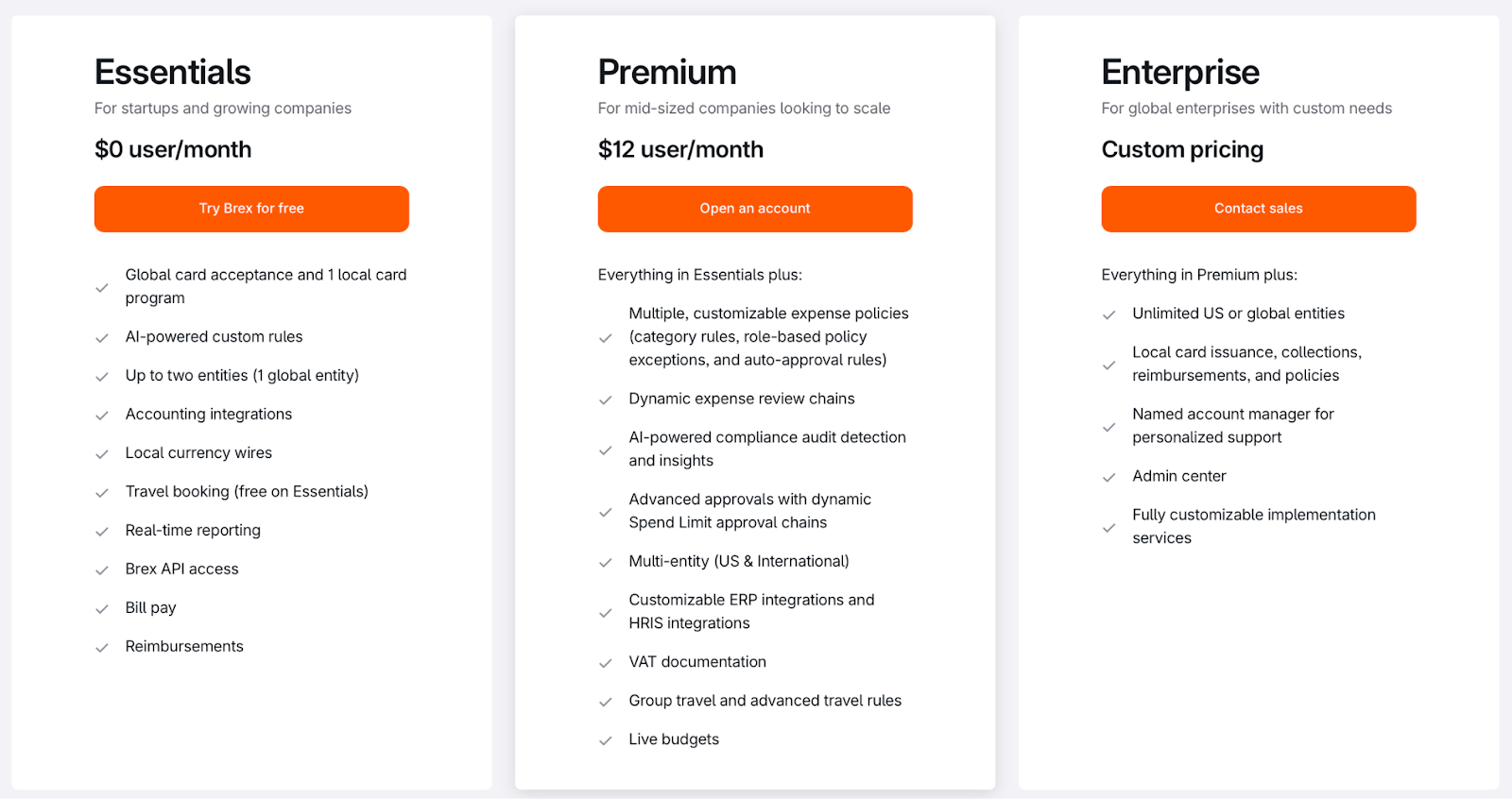

2. Brex

Brex is a corporate card and expense management platform that centralizes spending across cards, reimbursements, and budgets in one place. It offers real‑time tracking, automated expense reviews, and accounting integrations to simplify financial workflows.

Key capabilities:

- Set limits by department, project, or merchant and adjust them instantly

- Issue cards and reimburse employees in local currencies across 120+ countries

- Automate receipt matching, policy checks, and approvals to reduce manual work

- Manage card spend alongside bill pay, travel booking, and basic accounting integrations

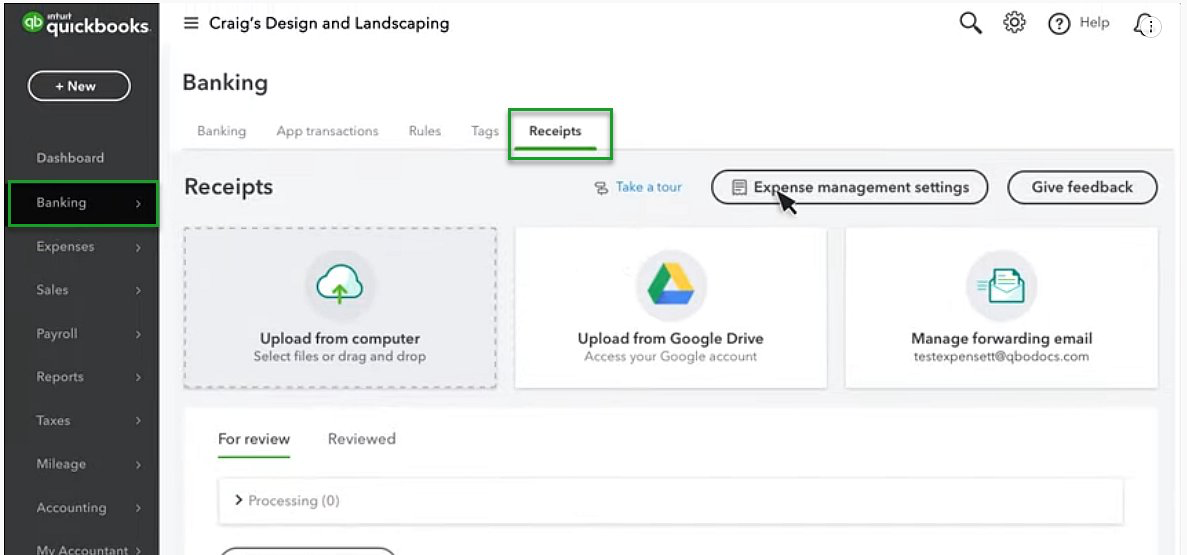

3. QuickBooks

QuickBooks is cloud‑based accounting software with basic expense management functionalities. It automatically monitors business income and expenses, categorizes transactions, and organizes financial data, eliminating much of the manual data entry small businesses often face.

Key capabilities:

- Link your bank accounts and credit cards to capture and categorize spending in real time

- Snap and upload receipts via the mobile app to keep records tax‑ready and organized

- Turn quotes into invoices instantly, schedule recurring invoices, and send reminders automatically

- Connect with over 200 apps, including eCommerce and payment platforms, and sync data directly to your books, generating reports like balance sheets or cash‑flow statements

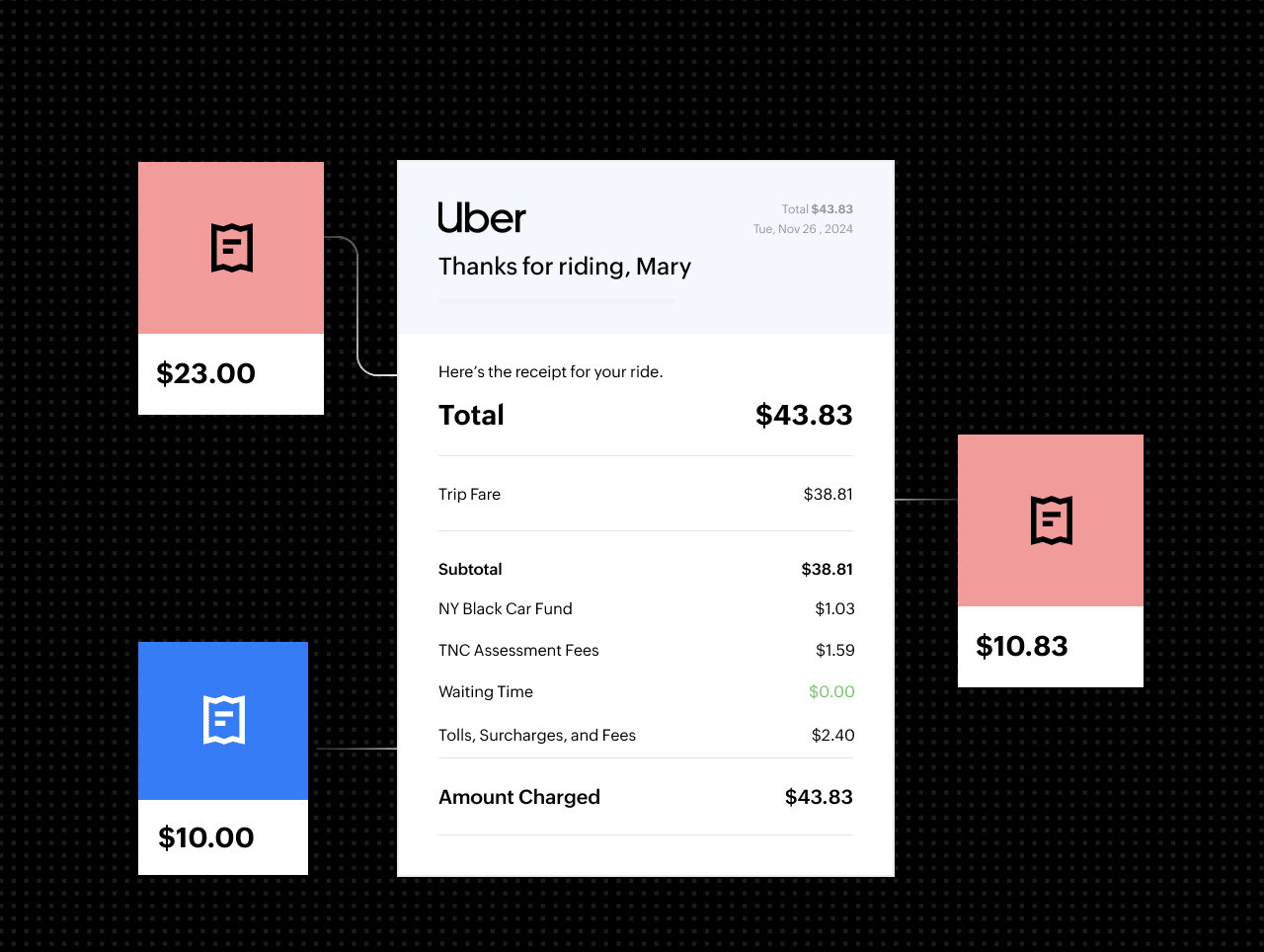

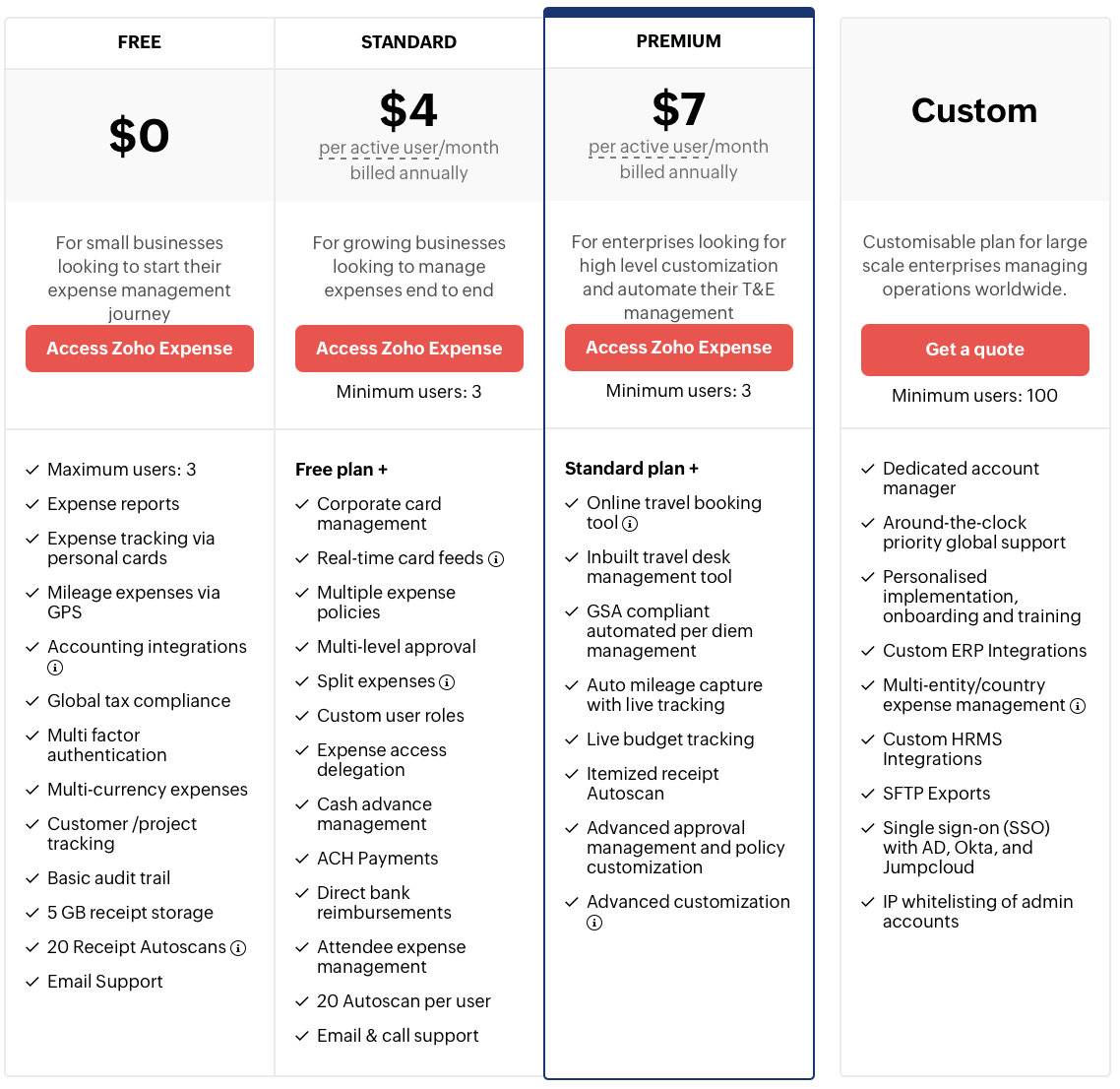

4. Zoho Expense

Zoho Expense is a travel and expense management tool that streamlines everything from trip planning to reimbursements. It’s designed for businesses that need to simplify travel bookings, speed up expense reporting, and maintain cost control without adding extra admin work.

Key capabilities:

- Employees can book flights, hotels, trains, and car rentals within policy guidelines, with pre‑trip approvals built in

- Auto‑scan receipts, calculate per diems, and submit expenses on the go for faster reimbursements

- Match card transactions with receipts in real time to reduce errors and simplify reconciliation

- Log mileage with a swipe, enforce category‑based spend limits, and flag out‑of‑policy expenses automatically

- Supports multiple languages, editions, and region‑specific compliance to fit businesses operating across markets

Industry‑Specific Applications of Expense Automation Software

Different industries face different spending challenges. But the right expense automation software adapts to each one. Here’s how it drives impact in three key sectors:

1. Legal

If you’re in a law firm, you know how easily small expenses tied to client work slip through the cracks: court filing fees, research subscriptions, last‑minute courier costs.

With automation, those receipts are captured the moment they’re submitted, tagged to the right case, and approved without back‑and‑forth.

2. Healthcare

In this domain, you’re balancing tight budgets with strict rules.

Maybe your team is ordering medical supplies across multiple departments. Expense automation software gives each department head clear budgets and routes every purchase through predefined approval workflows.

Any expense outside approved categories is flagged instantly, and every transaction is logged with a digital audit trail, ensuring it’s ready for internal checks or regulatory reviews.

3. Ecommerce and retail

If you’re running retail stores or an eCommerce operation, you’re probably juggling vendor payments, restocking, and marketing spends across multiple locations.

Expense report automation software enables you to track spending by branch, SKU, or vendor in real-time, set category-specific budgets, and manage multi-currency payments without the need for endless spreadsheets or manual reconciliations.

Benefits of Using Expense Automation Software

Beyond solving industry‑specific challenges, expense automation delivers everyday advantages for your finance team. Here’s how it can change the way you manage spending:

1. Streamlined operations

Manual expense management slows you down. Automating receipt capture, categorization, and approvals means fewer bottlenecks and faster processing. Instead of handling multiple systems or chasing sign‑offs, you can focus on higher‑value work like forecasting and strategy.

2. Enhanced financial control

With customizable approvals, spending limits, and departmental budgets, you can ensure that every purchase aligns with your policies and targets. Real-time dashboards enable you to identify overspending early and make adjustments before it escalates.

3. Time savings and team productivity

Every hour you used to spend chasing receipts or reconciling reports is time you can now spend on meaningful financial decisions. Automated workflows free up your team to focus on analysis, planning, and driving growth instead of paperwork.

4. Improved accuracy and compliance

Automation eliminates the errors that occur with data entry and lost receipts. Every transaction is validated against your policies in real-time, and an automatic audit trail ensures you can pass compliance checks without sifting through paper files.

5. Cost savings and spend optimization

A clear, up‑to‑date view of all expenses helps you spot waste, such as unused subscriptions, duplicate payments, unnecessary purchases, and act on them quickly. Fewer administrative hours and better vendor management translate directly to savings.

Practical Steps for Transitioning to an Expense Automation Software

Switching to expense automation software can transform how your finance team operates, but making the change requires thoughtful planning. Here’s how to set yourself up for success:

1. Evaluate and plan

Start by assessing your current expense management systems.

Identify where you spend the most time manually managing receipts, approvals, and reconciliations. Pinpointing these pain points helps you set clear goals for what you want to achieve with the software. For instance:

Do you need faster approvals?

Improved compliance with policies?

Better visibility into spending across departments?

2. Train and get buy-in

Once you’ve chosen the right software, it’s time to get your team on board. The success of the implementation depends on how well everyone adapts to the new system.

Demonstrate to your team how this new system will benefit them, whether it saves time, reduces errors, or enhances visibility into their department’s expenses. The more they understand the “why,” the more likely they are to embrace the change.

3. Implement in phases

With training complete, put your implementation plan into action. Set a clear timeline with specific milestones, such as:

- Week 1: Initial integration with your existing accounting tools (e.g., QuickBooks, Xero)

- Week 2: Create automated approval workflows and receipt capture

- Week 3: Test integration and fine-tune workflows

- Week 4: Go live and monitor the system for any issues

For a mid-sized team, allocate at least 1-2 months for the full rollout, including system configuration, team onboarding, and testing. Having a timeline ensures that everyone is on the same page and that you stay on track with your goals.

4. Optimize approvals and reporting

Once live, focus on making the most of your new system. You can set up customizable reports and track expenses across departments, locations, and projects.

Automated approval routing ensures spending is reviewed and approved on time, while also reducing bottlenecks. Leverage compliance checks to ensure that every expense adheres to policy, thereby reducing errors and unauthorized spending.

Ready to Move Beyond Spreadsheets?

Did you know 40% of CFOs report that automating expense management has helped them cut administrative costs and save time?

It makes sense!

As your business grows, managing expenses with spreadsheets alone becomes unsustainable. Expense automation software provides the visibility, control, and efficiency you need, freeing your finance team from manual tasks and helping you stay compliant while scaling confidently.

We’ve explored how it works, the key features, the best tools on the market, and even how different industries use it. With the right approach and a thoughtful rollout, you can unlock faster processing, sharper compliance, and smarter financial decisions for your business.

If you want to take the next step, start by evaluating your current processes and exploring platforms like Pluto, which bring real‑world control, real‑time insights, and scalable workflows into one seamless system.

Book a demo today to discover how Pluto can help you optimize your financial operations.

Frequently Asked Questions

1. How does Pluto’s expense automation software integrate with the UAE Federal Tax Authority’s e-invoicing and VAT filing systems?

Pluto seamlessly integrates with the UAE Federal Tax Authority’s Ta’heel portal via API. This allows you to automatically pull your Tax Registration Number (TRN), validate supplier e-invoices in real-time, map VAT line-by-line, and generate XML-compliant VAT returns ready for one-click submission, ensuring full compliance with UAE VAT regulations.

2. How does Pluto integrate with major UAE banks and digital-wallet ecosystems (e.g., Emirates NBD, Mashreq, UAEPASS)?

Pluto offers seamless integration with major UAE banks, including Emirates NBD and Mashreq, providing direct bank feeds for corporate cards. It also supports automated reconciliation against bank statements, one-click bulk payouts via Open Banking, and UAEPASS-based mobile approvals, eliminating manual entry and speeding up reimbursements.

3. What data-residency, security, and certification standards are critical for UAE businesses using Pluto?

Pluto follows the highest security standards to protect your company’s financial data. It is ISO 27001 certified, applies AES-256 encryption for data in transit and at rest, and complies with the guidelines of the UAE Telecom Regulatory Authority (TRA). Additionally, your data is stored within GCC-based data centers to meet local privacy mandates.

4. Does Pluto support Arabic-English dual-language invoices and reports for local audits?

Yes, Pluto allows you to upload Arabic receipts and scan them using OCR. It normalizes fields in both Arabic and English, ensuring that your bilingual P&L reports and audit-ready journals meet the requirements of both the FTA and local free-zone authorities. This makes Pluto an excellent solution for UAE businesses that need to manage invoices in both languages.

5. Can Pluto handle multi-currency expenses and AED-specific rounding rules?

Yes, Pluto supports multi-currency expenses and handles AED-specific rounding rules. It can automatically convert expenses into AED based on daily foreign exchange rates or those set by the UAE Central Bank. Pluto also applies the UAE’s “round half up” rule and flags currency discrepancies, ensuring your reports are accurate and compliant.

.png)

.png)

.webp)

%20(1).webp)