UAE’s Highest Cashback

Corporate Card

Unlimited cards with smart controls, AI-Powered Automation to save you 100+ hours every month.

Over 1,000,000,000+ AED in spend controlled for both industry leaders & SMEs

The Corporate Card for Modern Finance Teams

Trusted by 1000s of Finance Managers & Businesses

across EMEA - 2025

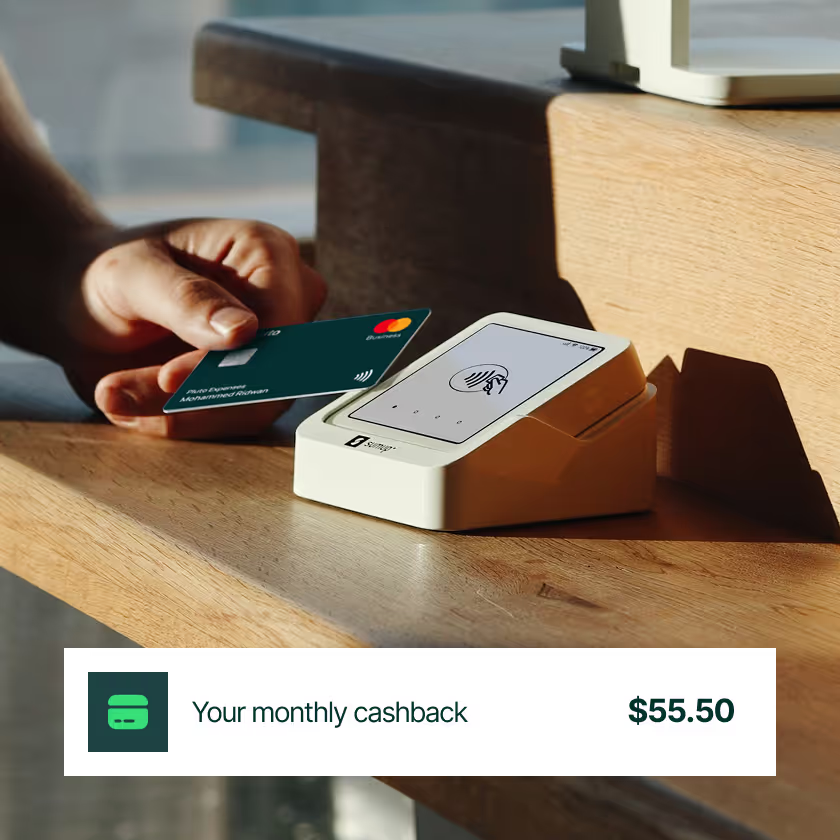

Smart Savings, Real Cashback

Highest cash back amongst all competitors

Earn the highest cashback in the market — up to 2% — making Pluto’s corporate cards more rewarding than any competitor’s.

0 AED/month for up to 10 users

Avoid hidden charges: Pluto allows you to scale smarter with expense management for up to 10 users at no cost.

Free airport lounge access

Travelling for work? All Pluto cardholders enjoy free access to over 500+ Airport Lounges around the world.

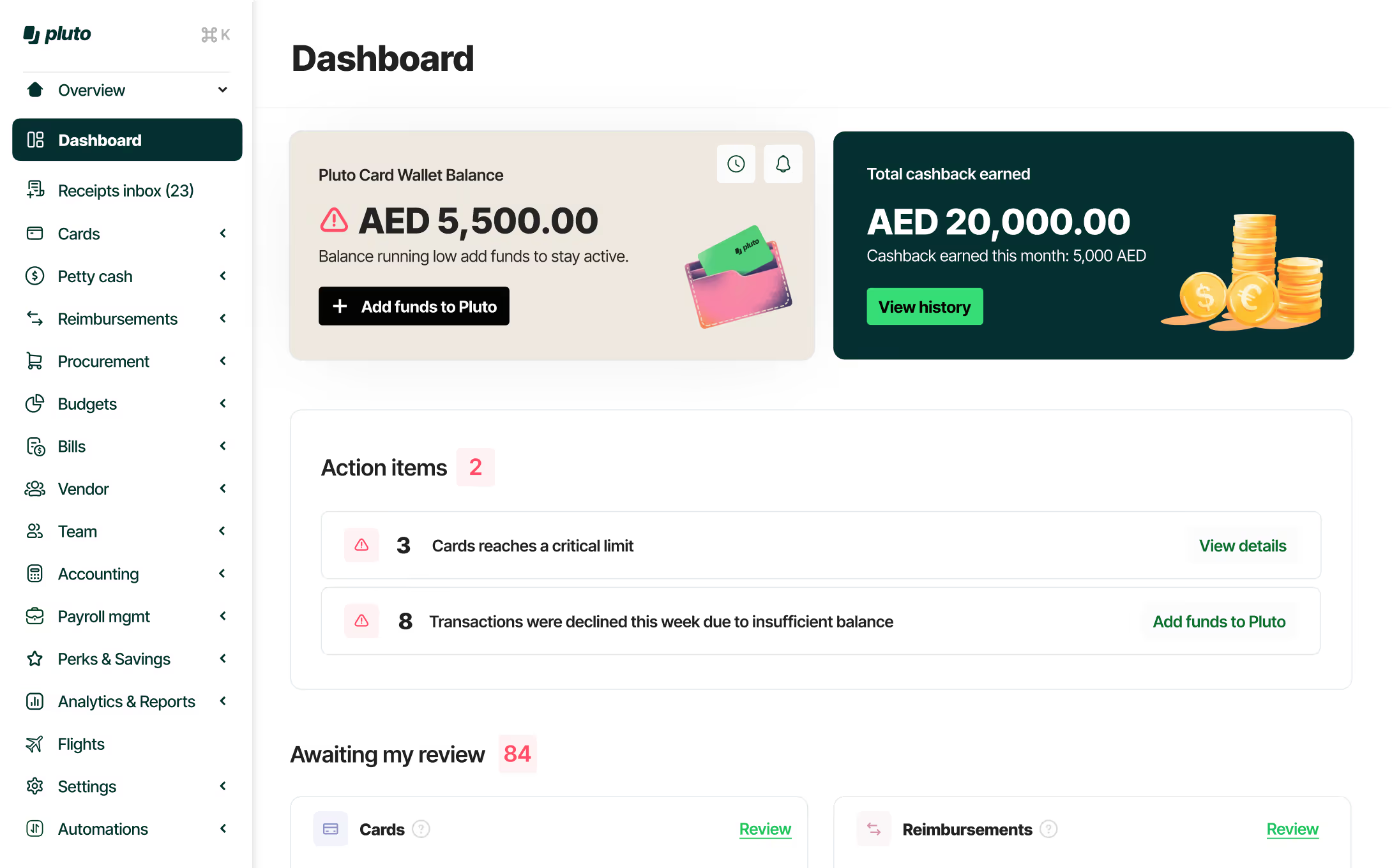

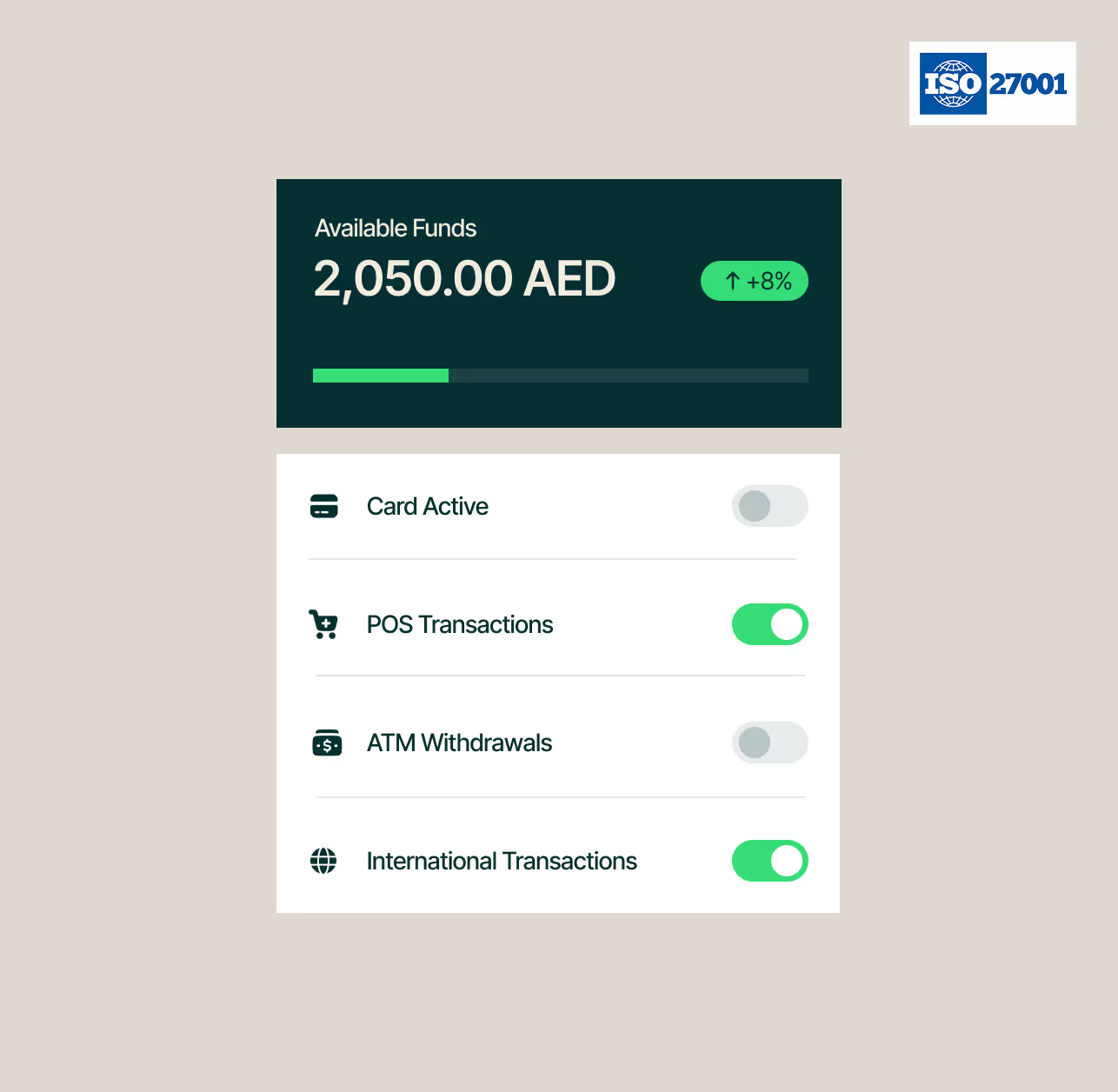

Corporate Cards that Control Spend Before it Happens

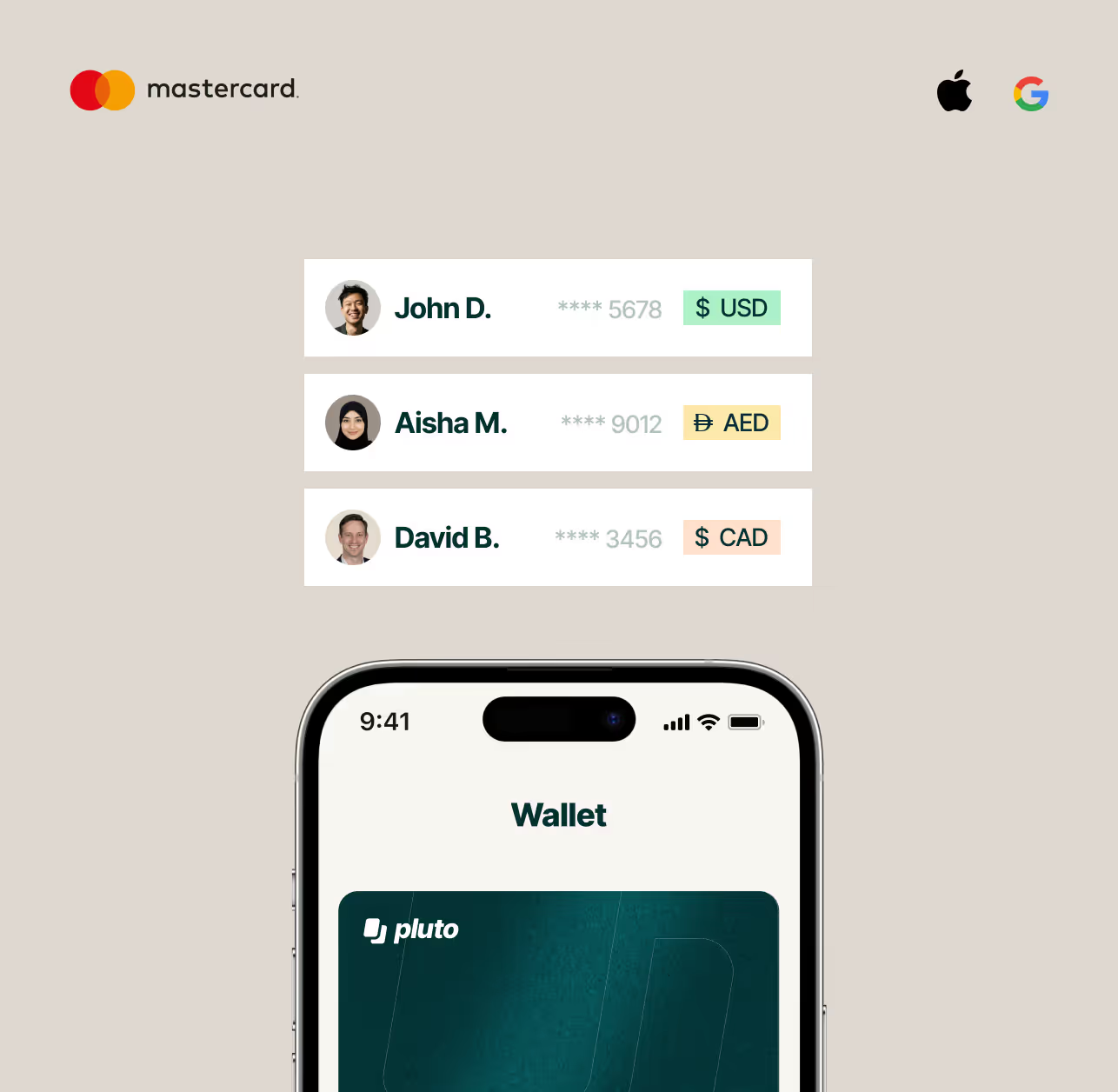

Cards for every employee & all expenses

Full control over every business spend

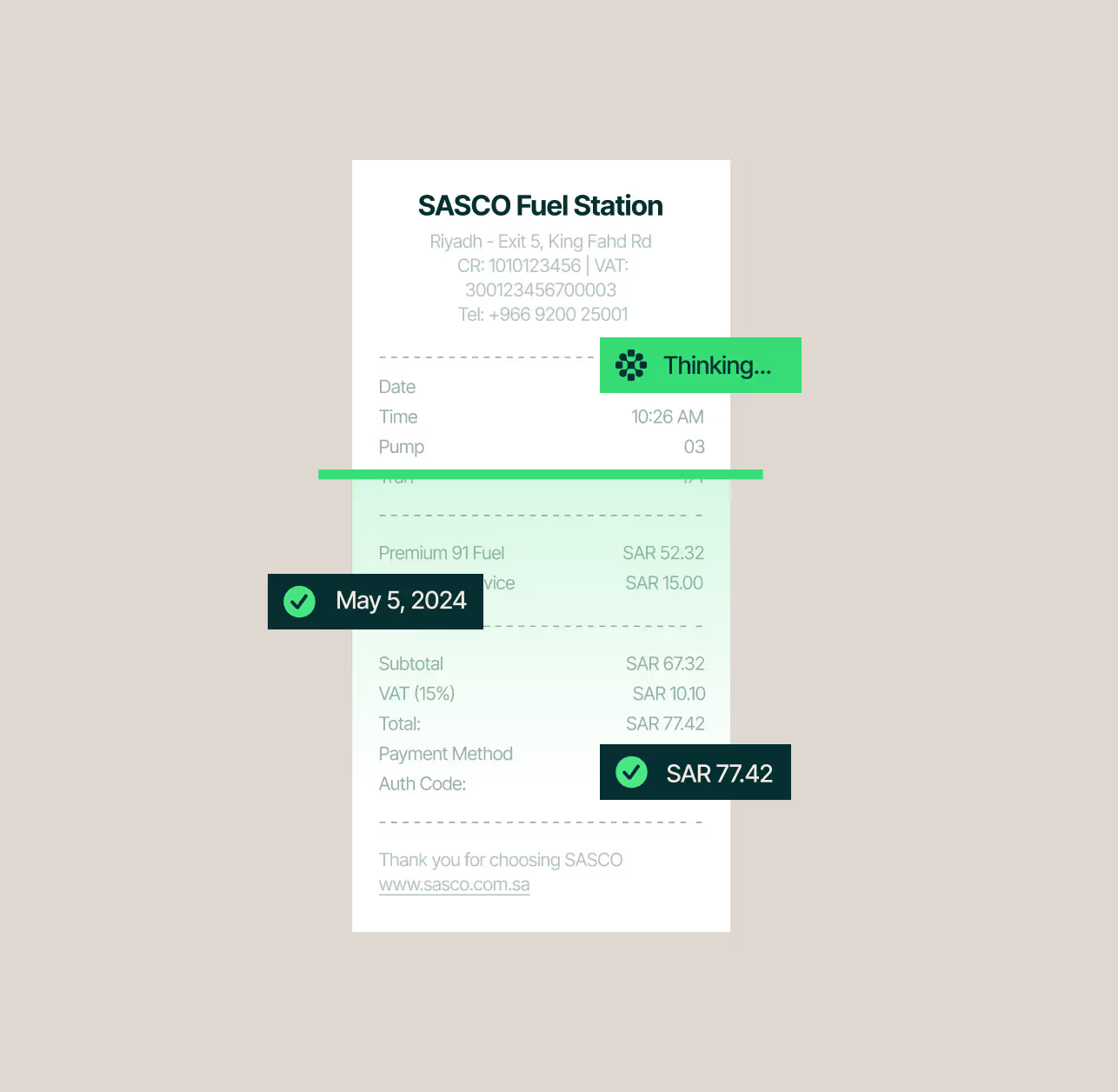

Track receipts using WhatsApp or mobile apps

Skip the manual work — let Pluto AI handle It

Industry Use Cases

50+ integrations:

Connect Pluto to your Ecosystem

See how Pluto Compares

Get a free

consultation!

Frequently asked questions

Pluto is a business spend management platform offering corporate cards, expense management, and financial automation tools to streamline your company's financial operations.

Pluto is built for businesses that want to keep expense tracking simple, stay on top of petty cash management, get clear, real-time spending insights, and avoid the usual hassle.

Our digital solution combines virtual corporate cards, automated expense tracking, and AI-powered insights in one platform. You get full control, better visibility, and less manual work without switching between tools.

Pluto works smoothly with platforms like QuickBooks, Xero, and NetSuite. All your data flows automatically, saving time and keeping records accurate.

Yes. Pluto supports international business payments, so you can pay vendors or partners globally without extra steps.