The sales team needs a new SaaS product for cold calling, but the approval is due. It has been weeks, and neither the finance nor the legal team has reverted. The sales team keeps following up, and the procurement team is stuck in the loop of approvals, only to spend some more weeks negotiating with the right vendor later.

This is a common scenario in most companies where teams follow a fixed standard operating procedure, and procuring basic items takes months. All this, combined with multiple tools, complicates procurement further. One tool to raise requests, one for approvals, one to manage vendors, and so on.

In this blog post, we will discuss how to automate purchase orders and simplify the procurement process. Instead of relying on hundreds of procurement automation software, we will look at how you can automate with minimal effort.

What is Purchase Order Automation?

Purchase order automation is the process of automating and removing all the manual tasks associated with creating purchase orders.

This is what the traditional procurement process looks like in most companies:

- Employees fill out forms to raise purchase requests, but have a long wait before they receive a response.

- The procurement team struggles to manage hundreds of purchase requests and seek approvals from different departments.

- The finance team is disliked by both employees and the procurement team because they focus on cost-saving and resource optimization.

As a result, there is continuous internal resentment.

Automating parts of this process lifts the weight off of each of them. Instead of relying on forms and different task management tools, you invest in centralized software to manage requests, set approval workflows, and maintain vendor databases.

How to Automate Purchase Orders

Here is a simple four-step method to automate your purchase orders:

1. Find the Right Automation Software

We have explored the top procurement automation software previously, which will help you evaluate the alternatives available. To pick the right one, look for the following features:

- Ease of use- To simplify adoption and reduce training time

- Flexible workflows- To adapt to complex organizational hierarchies

- Integration- To connect and sync with existing accounting systems and ERPs

- Reporting- To support data-driven decision-making and enhanced transparency

- Real-time visibility- To track expenses and identify thefts and fraud

- Scalability- To accommodate increased transactions and users without performance issues

2. Integrate With Your Accounting Software and ERPs

Connect your existing accounting software and ERPs to procurement automation software to sync vendors and transactions across multiple software platforms.

As a result, it becomes easier to maintain vendor databases and reconcile accounts. You can streamline purchase orders and eliminate chances of errors. You get real-time visibility into the status of orders, ensuring that relevant stakeholders are informed at every stage.

3. Set Up Policy and Approval Workflow

Create and enforce guidelines, rules, and approval hierarchies for purchase orders that align with organizational policies. This includes the following steps:

- Outlining the approval workflow to follow the organizational hierarchy

- Setting spending limits to control the amounts allocated in a single purchase order

- Syncing and defining the preferred vendor's list

- Specifying user permissions, access levels, and actions based on roles within the procurement process

- Activating alerts for relevant stakeholders about the status of purchase orders, pending approvals, or other critical updates

This step will enhance security, communication, and transparency throughout the procurement workflow.

4. Implement Automation

Finally, once you complete the setup, you will be able to automate the following parts of purchase orders:

a. Approval Workflows

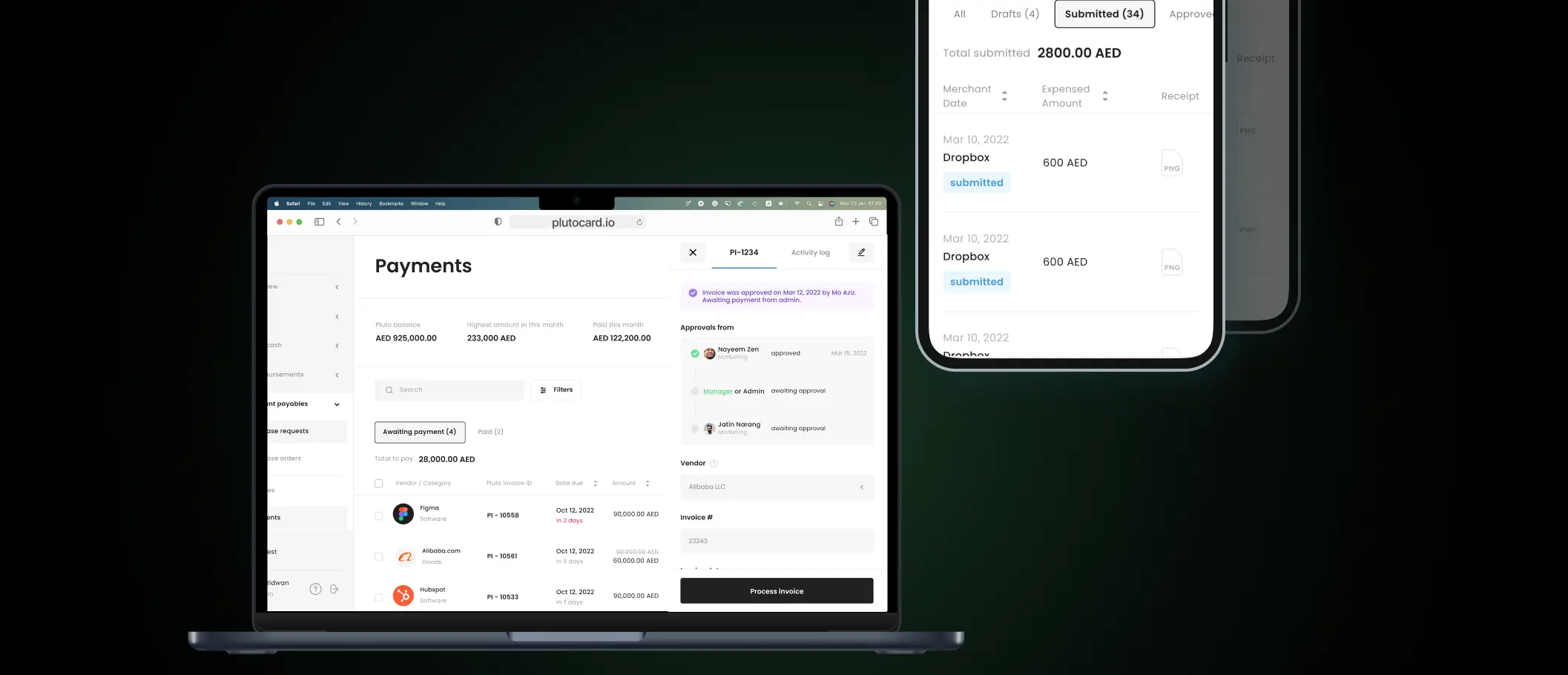

You can set up trigger-based approval workflows without requiring any technical expertise. From approving purchase requests to clearing payments, you can set up a proper hierarchy with all the required stakeholders.

So whether a purchase demands approval from three managers or three departments, you can accommodate the complexities without any delays.

b. Vendor Database

Instead of importing/exporting or manually maintaining vendor data in your procurement software, you can integrate the software into your existing accounting system and ERPs for a convenient two-way sync.

You can also create a list of items for each vendor, making two-way and three-way matching easier.

c. Receipts

Be it from email or WhatsApp, you no longer need to upload receipts and information in your system manually. The software captures the receipts and other key details via OCR, eliminating redundant record-keeping.

Additionally, you can bulk upload the invoices to add all the information in a centralized platform and sync across accounting systems. This simplifies reconciliation and provides complete visibility into each expense.

d. Expense Categorization

You no longer need to manually add tax and general ledger (GL) codes to any expense. Based on the key information extracted via OCR, the software categorizes the expenses. Plus, this syncs across platforms, accelerating reconciliation.

e. Goods Received Note (GRN) Matching

With OCR and receipt information retrieval, two-way and three-way matching becomes easy. The stakeholders can side-by-side compare the purchase order, invoice, and items listed. This significantly reduces the time spent on GRN matching and consolidates all the information on a unified platform.

f. Audit Trails

You get away with the need to maintain thousands of receipts and documents and get all the key information on a unified platform. From purchase requests to stakeholders involved and order status, you get complete visibility into each order.

This audit trail becomes a blessing during the audit season when you only need 30 seconds to retrieve a specific receipt or document.

How Automating Purchase Orders Makes Procurement Easier

While automation comes with multiple benefits, one reason to try it out would be gaining control and visibility.

You go from not knowing what the teams need, where the money is going, which department spends the most, or why these reports don’t make any sense to getting clarity on every aspect of procurement, not just purchase orders.

Here are five more benefits of automating purchase orders:

1. Reduce Error and Manual Tasks

You minimize the risk of human errors that come from manual data entry. For instance, a manual typo in the quantity ordered leads to complications and delays. Similarly, a mistake in categorization can cause legal issues. Automation ensures accuracy by eliminating such human errors.

2. Faster Reconciliation

You get real-time data synced across your accounting systems, easing the reconciliation process. The finance team can quickly match records, such as invoices and receipts, without delays and discrepancies. Further, this eases the process of GRN matching, helping you close books much faster with accuracy.

3. Streamlined Approvals

You accelerate the approval process for purchase orders even with complex hierarchies. Instead of waiting for physical signatures or manual confirmations, you get trigger-based approval workflows. As a result, you can set up a proper notification system to send purchase order requests to designated approvers, speeding up the entire approval chain.

4. Compliance Support

You can enhance compliance with organizational policies and regulatory standards. For instance, the system can flag a purchase order exceeding predefined spending limits, ensuring compliance with budget constraints. This helps prevent unauthorized purchases or deviations from established guidelines.

5. Scalable

You can scale procurement easily to meet the evolving needs of the business. As the organization grows, the automated system handles increased transaction volumes without affecting or increasing the manual effort.

Your Search for a Purchase Order Automation Tool Ends Here

Stop looking for different automation tools for each step in your procurement process. You don’t need an individual solution for purchase requests, purchase orders, and processing payments. You can automate it all on a single platform and ensure accuracy and consistency among your accounting systems.

At Pluto, our main aim is to stop the chaos and make procurement easier for three core stakeholders—spenders (employees), savers (finance teams), and sourcers (procurement teams). We streamline the entire process on a centralized platform and give you more visibility and control at each stage. And whether you want to automate one step or digitize your entire procurement process, Pluto gives you the flexibility to meet your needs.

Refer to our dedicated post on procurement automation to understand how a single procurement platform can sync with your accounting systems and automate the procurement process on a centralized platform.

.png)

.png)