Contents

What is Account Reconciliation? Basics for UAE-Based Companies

Mohammed Ridwan

•

•

Last day of the fiscal year, and you are closing the books. One of the employees writes a check for 50000 AED to a vendor. The internal records show a payment of 50000 AED, but your balance will not match your bank statement due to the time difference in check clearing.

Account reconciliation addresses these differences and mismatches of records. It helps you identify any gaps in your accounting statement to make adjustments and ensure accuracy.

In this post, we will discuss account reconciliation and how you can ensure compliance with proper reporting.

What is Account Reconciliation?

Account reconciliation involves comparing your internal financial statements to external and third-party sources, such as bank statements, to ensure the accuracy of financial records.

The frequency of account reconciliation will depend upon your company's internal policies and industry practices. Generally, companies conduct account reconciliations every month or quarter.

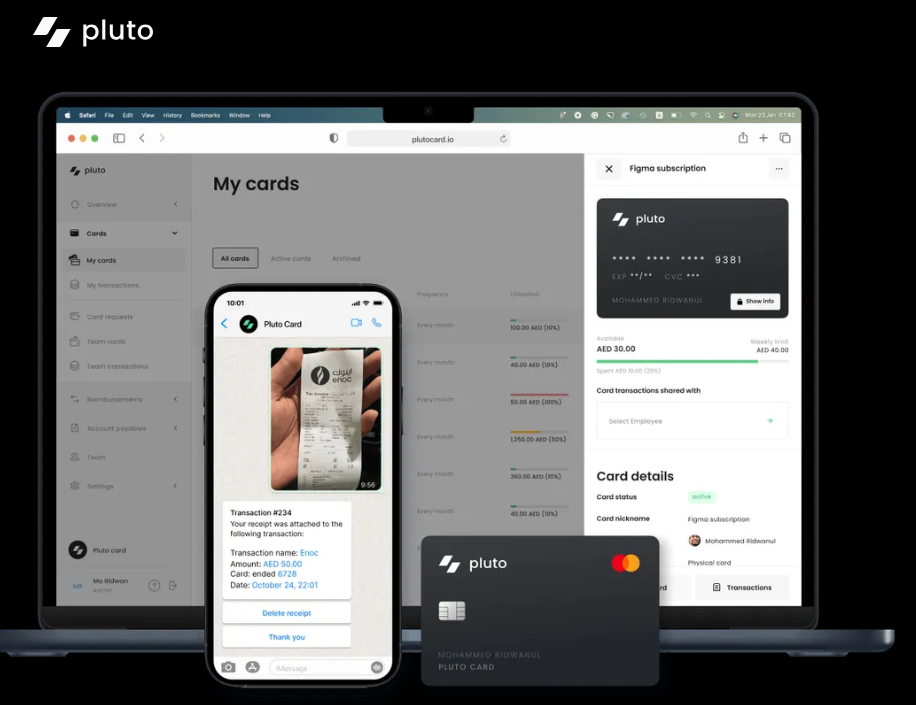

You can also automate this process and reconcile accounts in real time. The software integrates with your accounting systems and ERPs and facilitates record-keeping. Employees directly upload receipts on the software, and all the transactions are visible on a centralized platform for real-time tracking. Then, the tool automatically categorizes the expenses into different general ledger (GL) accounts and tax codes, making reconciliation simple.

Why Invest in Account Reconciliation?

Account reconciliation is a standard accounting process. While it seems reasonable to continue using traditional manual systems for record-keeping and reconciling, having a unified accounting platform enables you to close books 10X faster.

Imagine a single tool to manage reimbursement, petty cash, corporate cards, and end-to-end procurement. You eliminate the chances of errors and fraud with more visibility over your money. As a result, you get accurate financial statements, creating a transparent environment for stakeholders.

How is Account Reconciliation Done?

Account reconciliation involves comparing GL account balances to supporting external sources and records. Here is a complete breakdown of the process:

1. Identify Accounts for Reconciliation

Identify the accounts that need reconciliation. This depends on the nature of the business, industry regulations, and the company's internal processes. Common accounts include:

- Bank accounts

- Accounts payables and receivables

- VAT

- Inventory

- Intercompany transactions

- Revenue

- Expenses

2. Gather Relevant Documents

Collect supporting documents for the identified accounts, such as bank statements, invoices, receipts, and other relevant financial records.

3. Verify Opening Balances

Compare the opening balances in the company's records with the corresponding balances in external statements or supporting documentation. This ensures that the starting point for reconciliation is accurate.

4. Adjust Differences

Identify discrepancies and make adjustments as needed. Based on the types of accounts chosen, you are likely to have the following discrepancies:

- Bank: Outstanding checks, deposits in transit, or bank fees

- Accounts payable and receivable: For accounts payable, mismatch between the company's records and vendor invoices. On the accounts receivable side, payments not being accurately reflected in the company's records.

- Value Added Tax (VAT): Errors in calculating input and output VAT, misclassification of transactions, or discrepancies between recorded and actual tax amounts

- Inventory: Errors in recording stock levels, theft, obsolescence, or misclassification of inventory items

- Intercompany: Errors in eliminating intercompany transactions, misallocating expenses, or differences in intercompany balances

- Revenue: Unrecorded sales, errors in invoicing, or misapplication of revenue recognition principles

- Expenses: Unrecorded expenses, duplicate payments, or errors in expense categorization

5. Review and Finalize

Review the reconciled accounts for accuracy and completeness. Obtain necessary approvals from management or relevant stakeholders before making adjustments and finalizing financial decisions.

Finalize the reconciliation process and document the adjustments made. Retain all relevant records for auditing purposes and future reference.

Top 5 Account Reconciliation Errors

Here are the top 5 most common errors that lead to discrepancies in account reconciliation:

1. Omission

Omission includes missing certain transactions from the accounting records due to oversight. For instance, forgetting to record a payment received results in understating cash and accounts receivable.

Solution: Review transaction documentation, bank statements, and other supporting records to identify and record any omitted transactions.

2. Duplication

Duplication involves recording the same transaction more than once, leading to an overstatement of figures. For instance, recording a sales invoice twice causes excessive revenue figures.

Solution: Review transactions and eliminate any duplicate entries.

3. Timing Difference

Timing differences refer to situations where a transaction is recorded in the books at a different time than when it clears the bank or is recognized for accounting purposes. For instance, writing a check at the end of the month that doesn't clear the bank until the beginning of the following month.

Solution: Regularly compare bank statements with the company's records, adjusting for timing differences.

4. Fraud

Fraudulent activities involve intentionally manipulating financial records to deceive stakeholders and make personal gains. For instance, employees falsify expense receipts to inflate reimbursement claims.

Solution: Implement strong internal controls, conduct regular audits, and promote a culture of ethical behavior.

5. Misclassification

Misclassification occurs when transactions are recorded in the wrong accounts. For instance, adding a purchase of office supplies to the wrong expense account or labeling an incorrect GL code.

Solution: Review transactions to ensure proper coding and provide training to prevent misclassification errors.

Risk of Overlooking Account Reconciliation

While account reconciliation seems a redundant task of matching accounts’ balances, small defaults can lead to operational, financial, and legal challenges.

You can face hefty fines or penalties imposed by regulatory authorities. You may also encounter disruptions due to legal investigations, audits, or even suspension of business activities. Moreover, failure to adhere to regulations can harm a company's reputation.

In some cases, it leads to the revocation of licenses or permits, jeopardizing the company's ability to operate within the UAE.

Here are some challenges you face when you do not pay due attention to account reconciliation:

1. Manual Errors

The chances of errors are high if you rely on manual processes for account reconciliation. It can distort financial records, impacting decision-making and financial analysis.

Example: An employee records a sales transaction twice, leading to an inaccurate representation of the company's revenue.

2. Fraud

Detecting fraud becomes difficult when you lack real-time visibility or the accounts are not being cross-verified. As a result, fraudulent activities go undetected, causing financial losses and damaging trust.

Example: An employee manipulates expense reports to divert company funds for personal use.

3. Overdrafts

You lose sight of the funds available, leading to bounced checks or potential bank charges. This harms the company's financial stability and relationships with vendors.

Example: The employee wrote a check with insufficient funds, resulting in a bounced check and delayed vendor payment.

4. Inaccurate Reporting

You increase the chances of discrepancies in financial reports, providing stakeholders with misleading information. This undermines the confidence in the company's financial health and performance.

Example: An employee overlooking the balance between revenue and expenses leads to inaccurate profitability figures in financial statements.

5. Tax Issues

You can encounter inaccurate tax calculations or omissions, leading to tax filing errors. This leads to penalties, fines, and increased scrutiny from tax authorities.

Example: An employee's oversight of business expenses, like travel and meals, results in underreported deductions, leading to tax filing inaccuracies.

6. Affect Credit Score

You increase the chances of missed payments or errors that negatively impact the company's credit score. This further affects the ability to secure loans or favorable credit terms.

Example: An employee's oversight in paying a critical supplier invoice on time leads to late fees, strains supplier relations, and affects the company's credit score.

7. Audit Challenges

With incomplete or inaccurate reconciliations, you risk challenges during audits, demanding additional time and resources. This results in increased audit costs and potential legal implications.

Example: An employee fails to reconcile monthly bank statements, leading to missing documentation. The subsequent need for extensive audit adjustments increases audit costs and poses legal risks.

Automate For Ease

Managing 1000s of expenses and individually categorizing and coding them is a big headache for finance teams. Leaving this to your accounting software will further require oversight during audit season, adding to the workload. Moreover, these software don’t help with record-keeping or real-time visibility, causing you to spend more on account reconciliation.

Pluto makes this easier by bringing it all to a centralized platform. By shifting to the Pluto ecosystem, you close books 10x faster and simplify spend management. It is as simple as integrating your accounting software and ERPs and getting visibility over your money from Day one.

Streamline your financial management with our all-in-one platform, integrating accounts payable software for comprehensive control. Manage categorization, reimbursements, corporate cards, and all aspects of accounts payable seamlessly from a unified dashboard.

The best part is that you can bulk export and import logs and even lock the transactions to avoid changes once approved. Further, with view-only access to external bookkeepers, you ensure transparency and security with no chaos during audit season.

Reconciliation in Accounting Made Simple

Meeting compliance standards should not be an afterthought during the audit season.

You must adopt the right processes, standards, and tools to get complete control over your accounts. This will ensure accurate records and build trust amongst stakeholders. Moreover, the teams will have a proper systems to reconcile without rushing at the end time.

With automation, you make the process easier and more efficient. Pluto assists you with a centralized platform to automate your accounts payables and simplify account reconciliation without having to juggle multiple accounting software

Find out how much your business can save with Pluto

Discover your savings with Pluto's Cost Saving Calculator and take control of your expenses. Unlock cost-efficiency now!

Calculate NowLearn how Pluto is helping Keyper to eliminate petty cash spending and optimize spend management

Read More

Mohammed Ridwan, COO of Pluto

At Pluto Card, our mission is to assist businesses of all scales make well-informed choices. To uphold our standards, we follow editorial guidelines to guarantee that our content consistently aligns with our high-quality benchmarks.

Get started with a free account

Let Pluto do all the heavy lifting, so your finance team and employees can focus on things that actually matter and add to your bottom line. Get started with a free account today.

You may also be interested

•

Mohammed Ridwan

Top 7 Accounts Payable Software in 2024

Processing bills is the most difficult part of procurement.

Bill payments are often mistakenly duplicated, goods aren’t received as per purchase orders, or there are delays in the approval workflow.

An accounts payable software makes the process hassle-free by automating approvals and payments and giving more visibility and control over your accounts payable (AP). It also enhances reconciliation and improves vendor relationships.

While the core job to be done by an AP manager is to ensure good vendor relationships, manage between timely payments & cash flow, ensure compliance in payments, what you need is a solution that supports your organization’s finances in one place and ends the chaotic back and forth.

{{less-time-managing="/components"}}

What is Accounts payable software?

Accounts payable (AP) software is a tool that helps businesses automate invoice and vendor payments via a centralized platform. An accounts payable automation software brings together all the key information into a single source of truth and enables teams to do the following:

- Tracks bills and their statuses to avoid double payments

- Enables two-way and three-way goods received note (GRN) & PO matching

- Supports customizable approval workflows for complete visibility

- Supports local and international payments via various payment methods

Thus, AP software simplifies the payment processes and reduces unnecessary friction between finance, procurement & other teams.

Top 7 accounts payable software in 2024

Here are the top 7 AP platforms for businesses.

Based on your company size and needs, you can pick one of these to support your accounts payable.

1. Pluto

Pluto is an accounts payable software that transforms your AP processes by simplifying bill processing. From enabling GRN matching to setting fully customizable multi-layer approval workflows, it is the best accounts payable solution to manage your vendor payments and relationships.

Key features:

- Facilitates three-way GRN matching with purchase orders and item-based matching

- Consolidates approved invoices in a single window to highlight pending bills and avoid delays

- Offers a flexible approval engine capable of managing intricate hierarchies without requiring technical expertise

- Enables multi-layer invoice approvals with policies to align with your company's structure

- Ability to upload invoices easily via WhatsApp images and emails directly to speed up the receipt capture process

- A centralized dashboard to gather bills in one place and track the status to avoid double payments

- Vendor-specific corporate cards to control budgets and detect irrelevant expenses

- Enables creation of a preferred vendors list for quick payments

- Supports local and international wire transfers to make payments

- OCR technology minimizes manual data entry by creating and populating bills from invoices

- Supports ERP integration to synchronize your vendors, POs, and bills and integrates with accounting software such as Oracle, NetSuite, Zoho, Quickbooks, Wafeq, Xero, etc.

- Raises alerts for upcoming payments, enables scheduling payments in advance and automates invoices

- Provides a complete audit trail of the process to ensure visibility at each step

- Shows real-time analytics to facilitate deep insights for supporting budget control

Pricing:

Request the sales team for a custom quote.

Pros:

- Enables branch- and subsidiary-level spend tracking (not offered by other platforms)

- Offers up to 2% cashback on all non-AED transactions

- Independent PCI DSS Level 1 certification

- SSO/SAML Capabilities for Enterprises

- Integrates with Netsuite, Microsoft Dynamics

- Better Forex rates than most local banks

- Multiple integration options

Cons:

- Integrates with all other major ERPs except Tally

- Slightly longer on-boarding due to corporate card offering

{{less-time-managing="/components"}}

2. Tipalti

Tipalti is an automation tool that supports end-to-end AP processes. It helps you streamline accounts payables and make global payments in local currencies for various recipients, from suppliers to freelancers. The cloud-based platform helps finance teams manage payments without losing visibility and control.

Key features:

- Supports supplier onboarding and vetting to ensure supplier reliability and trustworthiness

- Integrates with ERP and accounting systems to help with reconciliation reporting

- Uses OCR to scan, capture, match, and process invoice data to reduce manual errors

- Provides built-in approval workflows and payment scheduling

- Offers invoice processing, including two-way and three-way PO matching and approval to avoid overpayments

- Assists AP processes for subsidiaries and entities

Pricing:

Starts at $129 per month per user for the platform fee and charges for additional features separately.

Pros:

- Can manage supplier bank account details in a secure environment

Cons:

- Cannot use it for prepayment invoices on inventory purchases with the ERP system

- High foreign currency exchange fees

- Tax forms can be difficult to fill out and very difficult if you do not speak English

3. Airbase

Airbase is an automation solution for managing global AP processes. It focuses on ensuring compliance and syncing with your accounting tool to streamline the payment process.

Key features:

- Offers OCR to populate details, including general ledger (GL) category, date, amount, and purpose

- Supports onboarding with a self-service vendor portal and custom questionnaires

- Has a centralized dashboard with all key information about the invoice to avoid friction

- Accepts invoices from email or vendor portal across all subsidiaries

- Offers automated approval workflows based on multiple parameters, such as vendor, amount, GL category, etc.

- Enables three-way invoice matching to ensure compliance and reduce wasted spend

- Facilitates payments and approvals, including multi-subsidiary support, international currency, and real-time GL sync

- Real-time audit trail with receipts, notes, and documentation for transparency

Pricing: Request a custom quote.

Pros:

- Intuitive and easy to use; no training or previous knowledge required

- Seamless approval workflows

Cons:

- The mobile app is slow and takes time to load pages

- SSO-based login is not smooth

- Not suitable for complex branch-level approvals and expenses

4. Ramp

Ramp is an accounts payable solution designed to manage payments and business expenses. It automates bill entries, approvals, and payments while offering complete visibility and control. By tracking each AP step from data recording to approvals, it simplifies payment processing and takes the burden off teams.

Key features:

- Uses AI to automatically extract key details from invoices to offer accuracy and eliminate data-entry errors

- Identifies duplicate invoices and helps with two-way matching to purchase orders

- Offers custom approval workflows to minimize errors and ensure timely payments

- Provides a unified dashboard with visibility into the status of invoices

- Consolidates multiple payment options, such as check, card, same-day ACH, or international wire

- Integrates with accounting solutions, such as QuickBooks, Xero, Oracle NetSuite, Sage, etc. for auto-sync bill pay transactions

- Supports international payment processing in multiple currencies

- Tracks vendor data and transactions for easy reporting and data-driven decisions

Pricing:

Three pricing packages—free or basic features, $15 per user per month for Ramp Plus, and custom quote for enterprises with features like enterprise ERP integration, custom implementation, and local card issuance.

Pros:

- Works with multiple subsidiaries

- Offers cash back on credit card purchases made using VISA cards

Cons:

- Can’t unmatch an incorrectly matched invoice (invoice to credit card)

- Approval routing can only be set on the vendor level, not department level

- Limitations in syncing repayments

5. Bill

Bill is a spend management solution for SMBs to control payables, receivables, expenses, and all corporate expenses. It allows businesses to streamline scattered AP processes into a single platform and gain more control over their finances.

Key features:

- Enables tailored approval processes to facilitate approvals with minimal hassle

- Automates purchase order workflows with the option for automated two-way and three-way matching

- Simplifies expense reconciliation through quick coding and integration with accounting systems

- Automates receipt matching, categorization, and expense reporting, decreasing administrative tasks

- Syncs with all major accounting systems like QuickBooks, Sage, Intacct, and NetSuite

- OCR auto-populates invoices for data entry

- Provides bulk payments of approved invoices with payment choices, such as ACH, credit cards, checks, and international wire transfers

- Offers audit trail of any changes or actions related to the invoice on a single page

Pricing: Provides a free trial and essentials pack starting at $45 for six standard user roles. Its team and corporate pack are for $55 and $79, respectively. Enterprises need to request a custom quote.

Pros:

- One-click swift payments

- Minimum training required

- Easy-to-use mobile app

Cons:

- Customer support is difficult to initiate, slow, and unresponsive

- Frequent changes in the interface create confusion for users

- Limited customization options for reporting

6. Melio

Melio is a bill payment tool that enables businesses to pay via bank transfer and debit cards. Even when the vendor accepts only checks, it pays checks on your behalf to facilitate bill processing. It processes payments and issues checks without the payee having to use the platform. It is a tool suitable for small businesses to process payments without hassle.

Key features:

- Enables payments via credit card even when the vendor doesn’t accept the card to support deferred payments

- Allows inviting additional users (such as accountants) to set up roles and permissions and manage approvals easily

- Supports two-way sync with QuickBooks and Xero

- Facilitates bulk payments and split payments (splitting bills into multiple payments)

- Offers international payments across the border

- Raises duplicate payment alerts to assist in fraud detection

Pricing:

Free to process ACH payments to vendors; charges a fee for other payment modes (check Melio pricing)

Pros:

- Offers a free-to-use payment module (only with QuickBook)

Cons:

- Lack of integration with accounting software

- Turnaround time on a check is three business days

- Support is very limited

- Limits payments to two checks per month

7. Spendesk

Spendesk automates the AP process by bringing together purchase orders and invoices to facilitate budgets, payments, and approvals. It creates a single source of truth to cut hours of manual work and detect errors better. It is a cloud-based software that improves budget control and financial reporting.

Key features:

- Offers a centralized platform for tracking payments right from the purchase order stage

- Supports invoice capture via email and image/file upload

- Uses OCR to extract key information from the invoice, such as supplier name, amount, dates, and purchase details

- Enables budget changes in real time without a manual data-entry system

- Allows scheduling of payments and matching of purchase orders with the invoice for effective GRN matching

- Provides customizable and built-in approval workflows and controls to monitor spending

- Raises alerts for duplicate invoices to enable teams to avoid overpayments and defect frauds

Pricing:

Pros:

- Super convenient for ad-hoc expenses

- Intuitive and interactive interface

- Easy manual upload in case OCR doesn’t support receipt capture

Cons:

- Glitchy virtual card payments with delayed notifications and declined transactions

- OCR-based receipt capture only works for emails

- Basic features like memorizing accounting patterns for vendors are only available in the paid module

What are the benefits of accounts payable software?

Adopting AP software helps you in the following ways:

- Gives real-time visibility into the status of invoices and payments

- Provides insights into spending patterns, vendor performance, etc.

- Streamlines payment and approval workflows, leading to smoother payment processes and vendor relationships

How to choose a good accounts payable Software

Ease of use

The AP software must be flexible to accommodate complex hierarchies without making it difficult to follow the workflows. It should offer trigger-based workflows and a clean user interface. Your team shouldn’t struggle to learn how to use the product and rely on the support team to get basic invoices cleared.

Multiple payment options

From local transactions to international wire transfers and other digital payment options, AP software must support multiple payment options. It becomes easier with vendor-specific cards that make payments safe and fast. Pluto helps you set up vendor-specific cards, even for public relations officers. This is something most platforms on the market do not support.

Accurate data capture

AP software with OCR capabilities makes invoice processing faster and reduces errors. The ability to process invoices from different platforms and sources, such as emails, Slack, and WhatsApp, is required. Moreover, moving these captured invoices into the centralized database and syncing with accounting software eliminates the manual data entry task.

Approval workflow

Approval workflows are key for timely and accurate payments. An AP software must have a simple no-code workflow builder, even for complex hierarchies. This is especially useful for large organizations where this process can be intricate and long.

Integration

Vendor payments need to be recorded across accounting systems for effective reconciliation. The AP software must integrate with your accounting systems and platforms to automate data entry and facilitate a synchronized record-keeping system.

Centralized dashboard

The AP software should offer a dedicated dashboard with all the key information such as vendor, invoice number, status, description, etc. Also, it must give a separate centralized view for expense tracking. This gives you visibility into where you spend the most and helps you optimize resource allocation.

Supports GRN matching

The AP software interface must be designed in such a way that it supports GRN matching, both two-way and three-way matching. Be it in the form of OCR invoice capture or offering item-based matching capabilities. This will avoid any under- or over-payments and support a healthy vendor relationship. Also, this eliminates complications in the reconciliation process.

Reporting

Reporting capabilities of AP software help to identify the spending patterns and other key insights related to department-specific expenses, budgeting, etc. Hence, AP software must provide a dedicated reporting dashboard with the option to export the reports for enhanced analytics and reporting.

Transforming Accounts Payable with the Right Software

Accounts payable is not just about clearing bills and vendor payments. It is the basis for vendor relationship management and proper order in financial processes. From getting approvals to matching GRN, you need software that offers ease of use with the right blend of functionality.

Too complex of a product will leave your employees confused, leading to double work. Lack of customization will have teams work harder to adopt the product. Limited integration will have the accounting department working twice as much on data entry and syncing.

Make the right decision and choose software that gives you control, customization, security and speed, all while embracing automation capabilities.

Book a demo and discover how a simple automation tool transforms your AP process.

Disclaimer: The comparisons and rankings of accounts payable software competitors in this article are based primarily on reviews found online. While we strive to provide accurate and up-to-date information, these reviews are subjective and reflect the opinions of the users who posted them. The information presented is intended for general informational purposes and should not be considered as a definitive guide for choosing a software provider. We encourage readers to conduct their own research and consider their specific needs before making a decision.

•

Mohammed Ridwan

How Corporate Fleet Cards Help Modern Transport & Logistic Businesses

Companies use petty cash for managing driver and transport expenses, including maintenance, repairs, and small purchases, by allocating a small amount of physical cash to drivers. Drivers submit receipts for reconciliation, and they manually track these small transactions.

However, tracking numerous trivial transactions becomes time-consuming, and discrepancies emerge during reconciliation. There's always a risk of misuse or theft, demanding strict security measures. Moreover, negotiating favorable terms with vendors for minor, recurring transactions becomes challenging. They must carefully budget and maintain a sufficient petty cash fund, which strains their overall cash flow.

Overall, the manual process raises efficiency concerns, necessitating a balance between control and practicality in managing day-to-day vehicle-related expenses.

A better alternative to petty cash is a fleet card.

This post will explore corporate fleet cards, their benefits for transport and logistics, and strategies to overcome potential fuel card challenges for improved spend management.

What Is Meant by Fleet Card?

A fleet card, also known as a fuel or gas card, is a specialized payment card used by businesses to cover expenses related to their vehicle fleets. It is issued by fuel companies or financial institutions specifically for fuel purchases, maintenance, and other vehicle-related expenses.

What Can Fleet Cards Be Used For?

The fleet cards are primarily used for fuel purchases, maintenance, and repairs. They facilitate seamless payments for routine servicing, tolls and parking fees, and purchasing vehicle-related products.

You get cards with custom spending limits and advanced controls, such as real-time transaction monitoring mechanisms, category-specific restrictions, and automated alerts for enhanced security and streamlined expense management.

Drivers purchase fuel, maintenance, and other vehicle-related expenses at authorized locations with the cards, and you enjoy complete visibility on a centralized dashboard for each transaction.

What Are the Benefits of a Corporate Fleet Card?

Switching from manual petty cash management to a fleet card yields the following benefits:

- Simplifies payment processes by reducing the complexity of cash handling

- Improves tracking and monitoring of all vehicle-related expenses

- Minimizes the risk of theft or misuse, providing enhanced security measures

- Automates the expense management and reconciliation process, eliminating manual record-keeping and ensuring accuracy with reduced likelihood of errors

- Promotes compliance by enabling you to set controls and restrictions on card usage according to company policies

- Enhances budgeting by providing detailed reports and insights into the spending patterns for a structured and controlled approach to managing vehicle-related costs

- Streamlines transactions with vendors, offering an efficient payment method for small, frequent transactions

Should I Use a Fuel Card or a Credit Card?

Fuel cards and credit cards share similarities in providing a convenient payment method for expenses. Both can be used at gas stations and offer detailed transaction records for monitoring expenditures. Moreover, both cards come with features such as spending controls, reporting tools, and rewards programs.

However, here are some differences between the two:

- Fuel cards restrict card usage to fuel and maintenance-related purchases, providing greater control and limiting potential misuse.

- Fuel cards come with fuel discounts or rewards programs at specific gas stations, providing potential cost savings that credit cards do not generally offer.

- While credit cards provide transaction records, fuel cards offer more detailed reporting on vehicle-related expenses like fuel consumption, maintenance costs, and odometer tracking.

- Fleet cards partner with fuel providers, service centers, and other vendors, allowing businesses to negotiate favorable terms and discounts for bulk purchases or regular transactions. For instance, a fleet card's partnership with a fuel station yields discounted fuel prices, facilitating substantial cost savings.

So, for transport and logistics businesses, corporate fleet cards offer specialized controls for fuel and maintenance, streamlined reporting, and potential fuel-related discounts.

What Are the Risks of Fuel Cards?

Fuel cards, tailored for fleet management, are designed to address the unique needs of companies in the transport and logistics sector. However, organizations face the following challenges when switching to corporate fleet fuel cards:

1. Gas Station Availability Issues

Fuel cards encounter challenges related to gas station availability that limit refueling options. As a result, drivers can not find suitable gas stations, leading to increased travel time and delays in delivery schedules.

3. Location-Dependent Acceptance

The acceptance of corporate fleet cards varies by location, leading to constraints and inconveniences for companies operating in areas where certain cards are not widely accepted.

Drivers will encounter difficulties during interstate routes if you offer a nationwide delivery service and the fleet card is only accepted at specific gas stations or regions. It complicates expense management and hinders the company's ability to streamline fuel-related transactions.

3. Management Complexity

The specialized design of fuel cards introduces an administrative burden when managed separately. For instance, a company using distinct fuel cards for different vehicles finds consolidating expenses difficult, leading to increased administrative efforts and potential operational inefficiencies.

As a result, administrators have a hard time reconciling statements, accurately tracking expenses, and ensuring compliance. This burden increases processing times and errors in financial reporting.

4. Reward Limitations

While crafted to suit industry needs, fuel cards encounter limitations in cashback offers. Consider a scenario where a company's preferred fuel card provides cashback benefits only at select stations, restricting potential cost savings for the entire fleet.

Why Should You Switch to Pluto Corporate Fleet Cards?

Pluto fleet cards don't restrict the use of cards at their discretion. Instead, they facilitate advanced controls and real-time visibility. From issuing budgeted fuel cards to creating vendor-specific cards, you can set rules that align with your company's needs and policies. Then, with each transaction, you track all fleet expenses from a single dashboard and get real-time data without manual effort.

So, you set cards and add controls, and you are good to go! Drivers can spend them at convenient gas stations while you enjoy complete visibility and control. Each transaction appears on the dashboard and notifies drivers to upload the receipt directly from WhatsApp. Once uploaded, you can approve the expense, and the data syncs with your accounting software to help you close your books ten times faster.

Here are the top six benefits of switching to Pluto corporate fleet cards:

1. Unrestricted Access Anywhere

Unlike traditional restrictions, Pluto corporate fleet cards liberate your drivers. There are no limitations on locations or specific fuel stations. Enjoy the convenience of using cards at the most budget-friendly and strategically located gas stations, repair shops, or truck stops that welcome Mastercard.

2. Easy Cashback

Pluto corporate fleet cards make cashback benefits straightforward. With up to 2% unlimited cashback on over 100+ currency spends, enjoy seamless cost savings without intricate conditions or restrictions.

3. Smart Budgeting

Pluto fleet cards, functioning as debit cards, provide smart budgeting without blocking cash flow. Drivers can request limit increases in seconds, ensuring operational flexibility with swift approvals. This distinctive feature sets Pluto apart, seamlessly blending budget management and uninterrupted cash flow for efficient fleet operations.

4. Driver-Friendly Controls

Provide drivers with budgeted fuel cards and set spending rules. Real-time data and advanced controls give you complete transparency of fleet expenses, enabling strategic decision-making.

5. Grow With Ease

Whether you have hundreds or thousands of drivers, the streamlined process of issuing corporate fleet cards and setting controls remains hassle-free, supporting your scalability with ease.

6. Eliminate Fraud

Lock or freeze cards instantly from the Pluto app, ensuring proactive measures against fraud. Enable company policies to ensure in-policy transactions, eliminating the risk of unauthorized spending.

Enhance End-to-End Spend Management

Pluto eliminates the need for separate investments in corporate fleet cards, offering an all-in-one spend management solution.

Pluto's comprehensive platform facilitates both corporate purchase cards and fleet cards, streamlining your financial operations. Enjoy the same benefits as traditional corporate fleet cards but with enhanced functionality, all within a unified platform. With Pluto, you get unparalleled efficiency in managing corporate expenses, ensuring a seamless and integrated approach to financial control.

Transform your spend management today. Book a demo and discover how Pluto can optimize your financial processes and elevate your business operations.

•

Mohammed Ridwan

SaaS Procurement: How to Optimize SaaS Purchases and Streamline Workflow

One of your teams discovers a SaaS tool and makes a quick purchase using the company credit card, thinking this software solution will simplify processes and increase efficiency. It seems straightforward at this point—a hassle-free process.

However, this purchase workflow shadows the IT and legal departments. None of them are involved in the decision-making process. As a result, the chosen product never undergoes the risk assessment for security threats and legal regulations. What appears as an elementary and frictionless process becomes a breeding ground for chaos and potential operational disruptions.

This blog post is for procurement teams that wish to understand the SaaS procurement process and streamline the purchases for efficiency. We will discuss the challenges with the traditional approach and how you can overcome these to create a secure and cost-effective tech stack.

What is SaaS Procurement?

SaaS procurement is the acquisition and management of cloud-based software solutions through a subscription model.

As a member of the procurement team, you assess organizational software needs, evaluate vendors, negotiate contracts, and oversee the entire lifecycle. You aim to ensure cost-effectiveness, compliance, and optimal performance of SaaS applications.

Challenges With Traditional SaaS Procurement Process

The most significant loophole in traditional SaaS procurement processes is the lack of proper approval workflow. Employees purchase suitable SaaS tools by themselves based on self-assessment. While this approach is flexible and saves time, it leads to operational bottlenecks in the long run.

Here is an overview of what happens when the relevant stakeholders aren’t involved in the SaaS procurement process:

Absence of Procurement Team

When teams proceed without involving the procurement team, they introduce several challenges, impacting the following aspects:

- Cost-Optimization: Without a centralized team overseeing SaaS subscriptions, different departments independently select similar plans, leading to redundant expenses. For example, two teams might unknowingly invest in the same SaaS product for $ 12/month/user plans. However, when consolidated under an enterprise plan, they could get added security features more cost-efficiently.

- Vendor Management: Vendor management becomes fragmented without a procurement team, as various teams engage with multiple vendors independently. Hence, It becomes challenging to negotiate favorable terms, track performance, and ensure consistent service levels across the organization. This absence of centralized management hinders the organization's ability to leverage its purchasing power effectively.

- Inconsistent User Experiences: Different teams choose diverse tools for similar tasks, resulting in variations in workflows and collaboration. This lack of standardization hinders overall efficiency and employees' ability to work seamlessly across different projects.

- Renewal Management: The decentralized approach of SaaS procurement makes it challenging to track and manage subscription renewals effectively. Unintended renewals for underutilized or obsolete SaaS subscriptions ensue, leading to unnecessary costs and potential inefficiencies in resource allocation.

Absence of Legal Team

Legal professionals evaluate and ensure that the chosen SaaS solution adheres to data protection and privacy laws. Also, they help craft and review contracts to protect the enterprise’s interests.

The absence of legal scrutiny leads to inadequate safeguards, exposing sensitive information to security breaches. Moreover, without their input, contracts with SaaS vendors lack clarity, leaving room for misunderstandings, disputes, or unfavorable terms. There's a high risk of violating laws, regulations, or contractual obligations, leading to legal consequences and financial penalties.

Absence of IT Team (Also Known as Shadow IT)

IT professionals assess the security measures of SaaS products. The absence of IT involvement results in security compromise and operational inefficiencies. Let's say the sales team, without prior knowledge of the IT team, independently procures a SaaS product for inbound leads, integrating it swiftly into their workflow. This incident is also known as shadow IT.

But after a few weeks, a technical issue arises. Unaware of the product's existence, the IT department struggles to provide immediate support or resolve the issues promptly. It disrupts the sales team's workflow and raises broader concerns for the organization, exposing the company to potential data breaches or regulatory non-compliance. Moreover, fixing this issue involves potential legal ramifications and additional unplanned costs for IT intervention.

6-Step SaaS Procurement Process

Each relevant stakeholder reviews and gets an overview of the purchase cycle — this is what a collaborative SaaS procurement process looks like.

1. Identify Need

This step involves identifying the specific software needs of the organization. Departments communicate their requirements to ensure the chosen SaaS solution aligns with overall business objectives. They fill out custom forms that become the procurement team's base to select the right vendor.

2. Vendor Selection

The procurement team researches and evaluates various SaaS vendors to find a solution that meets the identified needs. At this stage, it aims to find the best vendor that offers functionality and security at reasonable pricing. Factors such as vendor reputation, integration capabilities, and contractual flexibility shape the selection process.

3. Approval Process

Relevant stakeholders, including IT, legal, and finance, review the selected vendor and approve the procurement. This collaborative approach ensures that the desired SaaS solution complies with legal standards, aligns with IT strategy, and fits within the budget.

However, this collaborative approach can quickly become a root cause for internal resentment if you don’t lay out proper approval workflows. A lack of workflow makes departments wait for weeks, while none of the stakeholders has visibility over the process. There is unnecessary back-and-forth communication, and eventually, teams move to the traditional, flexible, yet risky SaaS procurement process.

If delays and friction in approval workflows disrupt your SaaS procurement process, centralized SaaS procurement software helps teams collaborate with minimal friction.

You can create proper approval workflows that define who needs to approve what. You get a no-code workflow builder, where you add if-then rules and make the desired workflow. You can have multiple workflows for different kinds of purchases, including parallel approvals as well.

For instance, a purchase request goes to the line manager, then the finance team, and after that, for a combined legal and IT review. You can have intricate workflows as required to suit your hierarchical structures.

With proper workflows laid out in a procurement automation platform, you simplify approvals. Moreover, a centralized dashboard makes it easier for each stakeholder to get an overview of the process without getting stuck in long email threads.

4. Purchase and Deployment

After approval, the procurement team finalizes contractual agreements with the chosen SaaS vendor. They negotiate on pricing models, licensing terms, and any customization requirements unique to the enterprise's needs.

Also, the procurement team ensures that the purchase aligns with the organization's budgetary constraints and financial policies. This step involves securing the best possible pricing and managing payment structures through one-time transactions or recurring subscription models. Further, the procurement team develops and finalizes contractual agreements with the vendor. This step involves clarifying terms and conditions, specifying service-level agreements, and addressing legal or compliance-related aspects.

With the procurement formalities completed, the deployment phase starts. Firstly, the SaaS solution has to be configured to align with the specific needs and processes of the company. This step ensures that the SaaS solution seamlessly fits within the organizational framework.

Secondly, the deployment team collaborates with IT and relevant departments to ensure that the SaaS tool integrates effectively with other applications to have a unified data ecosystem. Moreover, they establish and maintain robust access controls by defining user roles, permissions, and authentication mechanisms to safeguard sensitive data and maintain compliance.

5. Onboarding and Training

Once deployed, the onboarding and training phase ensures employees use the new SaaS tool effectively. This step is crucial for optimizing usage and ensuring that the software contributes to increased productivity.

Training sessions, documentation, and support materials are provided to familiarize end-users with the features and functionalities. This step minimizes the learning curve and maximizes user adoption.

6. Monitor and Renew

Once users are onboarded and the SaaS solution is integrated into the organization's workflow, the focus shifts to post-onboarding and ongoing management. This stage involves the following:

- Encouraging ongoing user engagement and collecting feedback, where regular communication channels help gather insights into user experiences and identify areas for improvement.

- Monitoring the SaaS solution's performance to identify and address issues promptly. The IT and support teams collaborate to resolve technical glitches, ensuring uninterrupted functionality and a positive user experience.

- Assessing functionality, user satisfaction, and alignment with business objectives to make renewal decisions. Simultaneously, compliance with legal and regulatory standards remains a significant consideration to avoid potential risks.

Collaborative Effort for Efficient SaaS Procurement

While SaaS procurement seems like a small piece of the puzzle, choosing and implementing it requires attention to detail to avoid operational and financial shocks. Each team needs to work together and help create a secure and cost-effective tech stack for the organization.

However, collaborative efforts demand a centralized platform to overcome two core challenges — delay and friction. We have shared the top nine procure-to-pay software for enterprises for you to find solutions that transform the SaaS procurement process.

Modern finance teams save time & money with Pluto.

Get started today

Join 2000+ finance professionals keeping up to date with the latest news & releases.

© Pluto Card is a Pluto Financial Services Inc. company 2024

The product and services mentioned on this webpage belong to Pluto Technologies Ltd (Pluto), a company incorporated under the laws of Dubai International Financial Centre (DIFC), Dubai holding commercial license number CL5294. Pluto is a financial technology provider and not a bank. Pluto provides certain facilities for the utilization of payment services through Nymcard Payment Services LLC under the applicable payment network and Bank Identification Number Sponsorship of Mashreq Bank PSC. This is pursuant to the license by Visa® Inc and is available for the residents of UAE subject to Terms and Conditions of use