From receiving goods to clearing payments, it is not a single-click process. Multiple steps in between make the accounts payable process tedious and time-consuming.

You receive goods, match them with purchase orders and invoices, send the invoices for approval, make the payment, and finally, maintain records for bookkeeping. This process alone takes weeks and creates confusion when multiple stakeholders are involved.

Think about purchases above $50,000. There are multiple approvals, and each purchase triggers a unique workflow. Documents are not consolidated, and no one has a clear idea of the payment status.

Thus, accounts payable become chaotic.

Can You Automate Accounts Payable?

To streamline your accounts payable process, you can use tools to automate it. This will simplify bill payments and give you more visibility and control over money.

While it will take time for stakeholders and employees to embrace automation, you can consolidate your scattered pieces on a centralized platform. If you are looking for suitable AP automation tools for your company, check out our list of the top accounts payable automation software.

This post will delve deeper into how you can automate the accounts payable process and how it will help your business.

{{less-time-managing="/components"}}

What is the Accounts Payable Automation Process?

Accounts payable automation uses tools to automate invoice verification, approval workflow, payment processing, and bookkeeping.

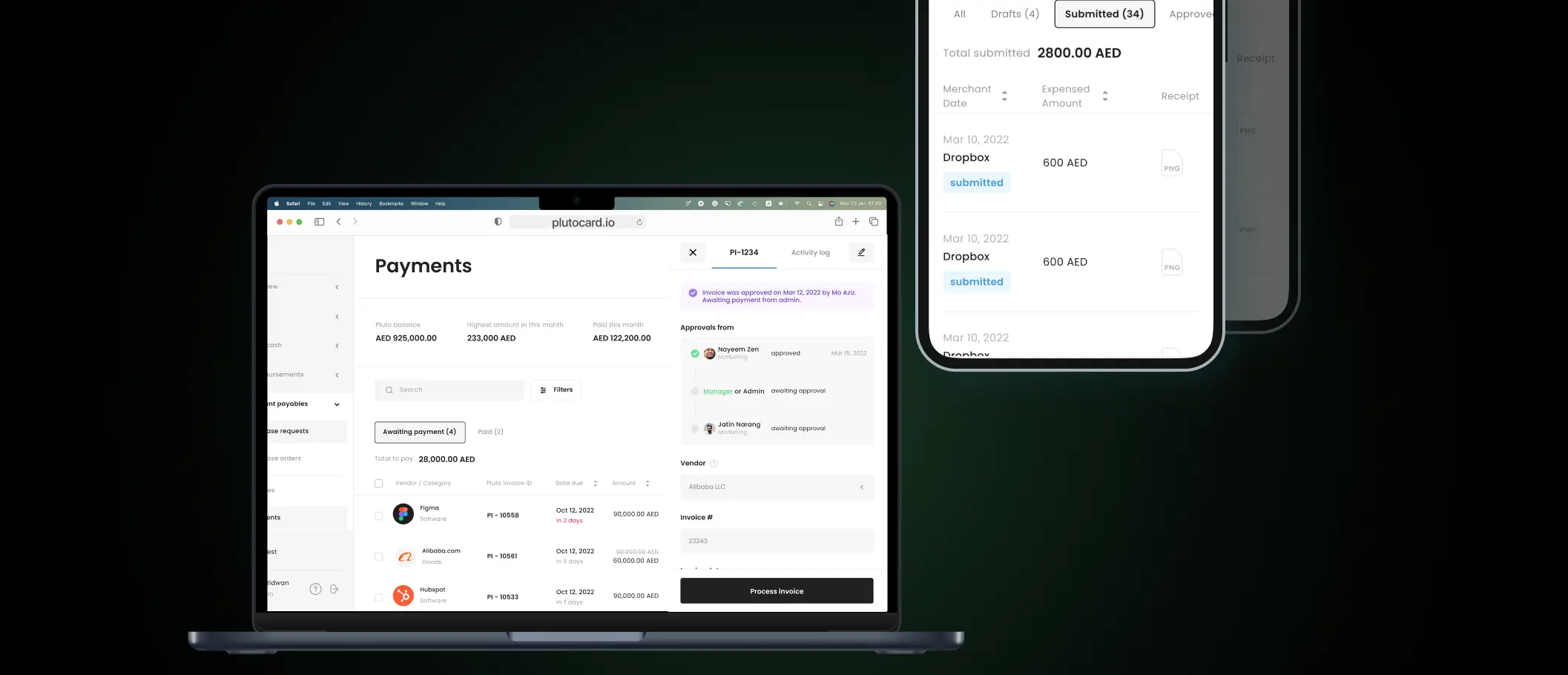

Instead of manually organizing, matching, approving, and clearing invoices, the entire process goes on a digital platform to provide visibility and control at each step. So, earlier, employees would spend hours getting approvals and days clearing payments, but now, an automation tool reduces the invoice processing time.

The platform captures and extracts the invoice from emails via optical character recognition (OCR). The invoice goes to the platform with all the critical information, such as purchase order and simplifies three-way matching. A trigger-based approval workflow notifies the stakeholders to approve invoices. The admin gets complete visibility of each step and clears the payment without going through a variety of software.

How to Automate Accounts Payable

Automating accounts payable is as simple as choosing and integrating the right automation software with your existing accounting and procurement software.

The automation software offers visibility into where the money is going and control over the entire process. You can customize the approval workflows and payment gateways and create an ecosystem that supports your procurement process. You can accommodate manual processes and integrate them with other software without going through a complete flip.

With the right automation software, you bring all the critical stages of accounts payable on a centralized platform. Here are the five key steps you can automate:

1. Invoice Management

Manual: The vendor sends an invoice to a dedicated email or a physical copy via fax or mail. The employee receives it and moves from one stakeholder to another for approval. The process is delayed for days if any manager is unavailable. Once the approval is complete, all the documents go to the accounting team, who clears the payment.

Automated: Depending on how the vendor sends the invoice, the automation platform captures the invoice from email or WhatsApp. If you receive a physical invoice, you can upload the invoice, and the system extracts all the vital information via OCR. There's no need to manually enter details or add a general ledger (GL) and taxation code. The system captures, extracts, and consolidates all the invoices.

2. GRN Matching

Manual: The dedicated team receives goods along with the goods receipt note (GRN) and must match it with the invoice and purchase order. This ensures that the specified goods are received as per the purchase order. Manually, this process is prone to errors, leading to discrepancies. It demands accuracy to ensure you receive the correct items in specified quantities.

Automated: Automated software makes this easy by combining all the relevant documents on a single platform. The dedicated team has the invoice and purchase order side by side, making it easy to compare items, purchase orders, and invoices for three-way matching. As a result, spotting discrepancies becomes more manageable, reducing the chances of errors.

3. Approval Workflow

Manual: Once the invoice is received, the employee gets it approved by dedicated managers. Based on the invoice amount, they need more than a single approval. Manually, this means going from one office to another or delving into long threads of email or Slack conversations. It becomes difficult for accounting teams to track approval and clear payments.

Automated: With automated software, each invoice triggers an approval workflow for relevant stakeholders to approve the payments. The admin can create custom no-code workflows based on different if-then rules. For instance, marketing purchases above $50,000 will have more approvals than expenses of $5,000. Also, all the relevant teams will have visibility into the approval status, making it easier to clear payments on time without confusion.

4. Payment Processing

Manual: Once the invoice is approved, the accounting team determines the details and pays via checks, cards, or other payment methods. It takes a few days before the payment is cleared, and the teams need to sync all the information across the accounting software for reconciliation.

Automated: With automation, accounting teams and employees enjoy more flexibility. For instance, Pluto offers corporate cards, payment gateway integration, and a digitization platform for bookkeeping.

- With corporate cards, you can create custom vendor-specific cards with advanced controls to ensure payments are made only for approved vendors.

- Pluto integrates directly with your payment gateways to facilitate payment within the platform.

- If you make payments via checks or other physical modes, Pluto will act as a digital bookkeeping platform. You can enter the payments made on the centralized platform and ensure that all the information is streamlined.

5. Reconciliation

Manual: Reconciliation is the messiest part of accounts payable. Teams must maintain records, manually enter all the details, and sync them across the accounting platforms and ERPs. It is time-consuming, prone to errors, and tricky in case of purchases where one invoice invites multiple tax and GL codes.

Automated: Automation consolidates all the information on a single platform without manual data entry. It uses OCR to extract all the critical information with a feature to upload the invoices in bulk. Further, you can split the transactions to add multiple tax and GL codes to address the audit season rush.

How Accounts Payable Automation Simplifies the Procurement Process

Accounts payable automation is not just for the procurement or the accounting department. It also makes it easier for stakeholders to approve the payments and employees to get timely resources.

Overall, it assists you in bringing together scattered parts of the procurement process. Here are reasons why you must invest in accounts payable automation:

1. Improve Compliance

You get complete visibility and control over your accounts payable. You can create custom workflows to ensure that any purchase that goes against the company policy is rejected. You can also accommodate intricate hierarchies to suit your organization's needs and get timely approvals.

2. Avoid Double Payments

It is usual for teams to end up paying the same invoice twice as no one has visibility into the payment status. It happens when the same invoice is paid twice by different team members or when vendors send the same invoice twice, and both get paid. You can avoid this as the software detects duplicate invoices and gives visibility into the status of invoices. The main dashboard highlights the pending invoices and the ones awaiting approval. It becomes easy to stay on top of all the invoices and avoid errors.

3. Faster Approvals and Matching

You get a trigger-based no-code approval workflow engine where you can create customized workflows to accommodate intricate hierarchies. The software notifies the stakeholders to review and approve the invoices. Since all the information is available on a single dashboard, two-way or three-way matching is a matter of a few minutes. This accelerates the approval process, and payments are disbursed much faster. It improves the vendor relationship without risking over, under, or delayed payments.

4. Better Reconciliation

You get all the relevant documents consolidated on a single platform with the appropriate purchase. Additionally, the software automates the coding and categorization, simplifying the reconciliation process. In case of discrepancies, spotting errors becomes easy. Moreover, with features like locking the approved payments and restricted access for auditing, you can eliminate the chances of fraud or manipulation.

5. Accuracy

You improve the accuracy of your records and GRN matching with all the information streamlined on a single platform. Moreover, as the software relies on OCR, you eliminate the need for manual data entry, reducing the chances of errors. Also, you can integrate the automation software with your accounting platform and ERPs to sync data and ensure consistency across the platforms.

6. Centralized Dashboard

You get a centralized dashboard with all the key information available in a unified place, acting as a single source of truth. Additionally, you get insights that can help in data-driven decision-making to facilitate procurement cost savings. Further, you can view all the awaiting payments and approvals on a dedicated dashboard. You no longer need to run from one platform to another for information as the software integrates with your accounting system.

7. Accessibility

The unavailability of a single person can create bottlenecks in the approval process and block the supply chain. With all the information streamlined on a single platform, each stakeholder can access relevant data for decision-making. So, whether the CEO is traveling or the CFO is not at the office, they can access the details from any corner of the world and avoid disruption in the supply chain.

8. Visibility

You get visibility for each step, each document, and each purchase. You can bring the entire procurement automation on a single platform and track the status in real time. Whether an employee raises a request, gets an invoice, or needs to clear payment, you will stay on top of the information without creating any delays or friction.

Automation is Easy With the Right Software

Adopting automation software isn’t easy, especially for critical processes like accounts payable, which also involve external stakeholders. The top three factors to look for in appropriate software are flexibility, visibility, and integration.

Choose one that integrates with your existing processes and systems and is flexible enough to accommodate complex hierarchies. Instead of focusing solely on the accounting or procurement team, it should cater to all the key stakeholders and make automation easier to adopt.

At Pluto, we aim to bring a balance among the spenders (employees), the savers (finance teams), and the sourcers (procurement teams). Each stakeholder gets visibility, and decision-makers get flexibility. Pluto integrates with your current system and enables you to automate accounts payable without affecting the supply chain.

You can also automate your entire procurement process with Pluto and improve your bottom line. Read more in our procurement automation post.

.png)

.png)