Every business has small, everyday expenses that keep things moving, such as courier fees, printer ink, snacks for the team. You get the gist.

Now, on their own, they seem trivial. Yet research shows businesses lose about 5% of revenue annually to fraud, with weak controls over petty cash often being the culprit.

If you manage petty cash, you know how quickly receipts go missing or balances slip out of line. Reconciliation becomes tedious, and you’re never entirely certain everything is accounted for. This blog post aims to change that.

Here, you’ll learn what petty cash accounting actually involves, how to create a system that fits your business, and ways to keep everything in order with clear policies and smart tracking.

You’ll also learn how digital tools like Pluto can bring transparency and ease to the process so that petty cash supports your team, rather than stops it. Let’s get going.

What is Petty Cash Accounting?

It refers to the process of managing a small fund of physical cash that your business keeps on hand for everyday, low-value expenses.

Instead of using checks or company cards for minor purchases, employees can draw from petty cash for quick needs like parking fees, courier runs, or emergency team lunches, eliminating the need for lengthy approval or reimbursement process cycles.

Petty cash accounting records each transaction, reconciles balances, and outlines clear usage policies to keep the fund both useful and secure.

How to Set Up a Petty Cash System

The steps are clear and easy:

1. Establish a petty cash fund

Start by deciding how much money should be available in your petty cash fund.

The amount should be large enough to cover common day-to-day costs but not so large that it becomes risky to keep in cash. For a small office, $200–$300 may be plenty. Larger teams with frequent incidental costs might set aside $500–$1,000.

Next, assign a custodian. This is usually someone in finance or office management who’s responsible for issuing cash, collecting receipts, and keeping records up to date.

Name a backup custodian in case the primary person is unavailable, and store the money in a secure place such as a locked cash box or drawer.

For stronger internal control, require two people to sign off on larger disbursements and on every replenishment. Also, separate responsibilities so that the person who approves expenses is not the same person who physically handles the cash.

Finally, create an entry in your accounting system showing how much cash was withdrawn from the bank and assigned to petty cash. This way, you can track the funds from day one.

2. Define petty cash policy

Once the fund comes into existence, outline what it can be used for, how employees should request it, and the expectation that receipts are always provided. Even a short, one-page petty cash policy will help set clear boundaries, prevent misuse, and keep reconciliation clean.

Here’s what you need to do:

- Identify the maximum amount that can be spent per transaction; many businesses cap this at $50 or $100 to ensure the fund only covers incidental expenses

- List the types of expenses allowed (e.g., parking tickets, small client gifts, light refreshments) and explicitly state what doesn’t qualify (e.g., salary advances, large equipment, personal costs)

- Require employees to provide a dated receipt for every transaction, and be clear that expenses without receipts may not be reimbursed

Petty Cash Policy Snapshot:

3. Maintain a petty cash log

A petty cash book or log is your record of every transaction. It should include the date, amount, employee name, and purpose of the expense. Traditionally, businesses have used a paper ledger or a spreadsheet.

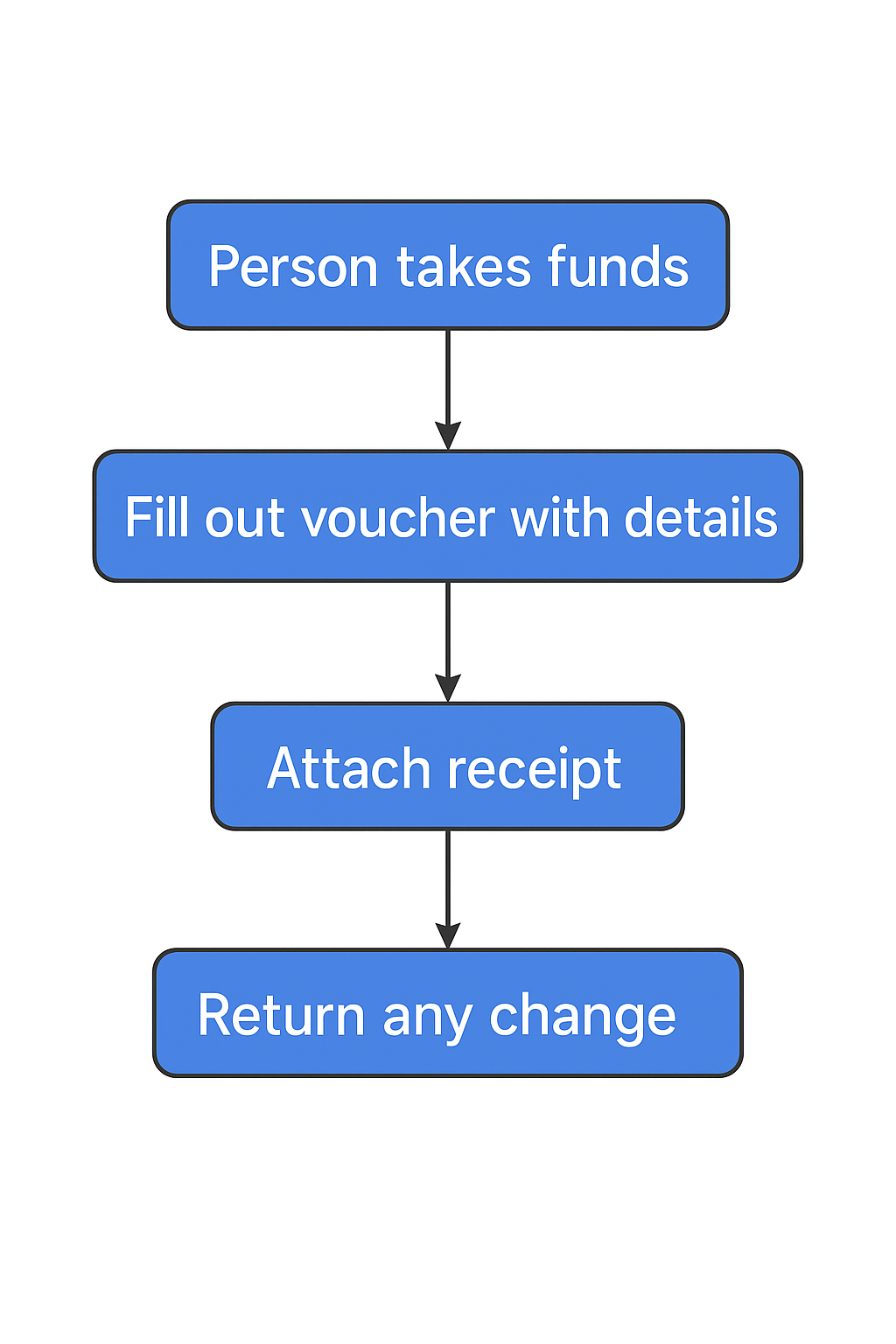

In manual setups, a voucher system works well, ensuring all cash movements are traceable, looking like the following:

However, as you know, manual systems have limitations, such as lost vouchers, human error, or delays in updating. On the other hand, digital logs make this process far easier.

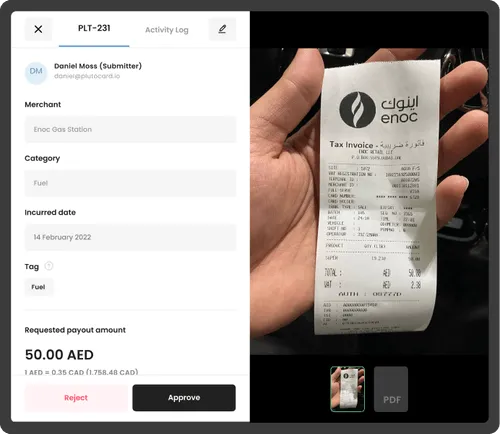

For instance, with the expense management software Pluto, you can upload receipts and log expenses instantly via WhatsApp. Pluto’s automated OCR extracts details in real-time for reconciliation.

Tracking Petty Cash Expenses

With your log in in place, the next task at hand is to keep it up to date and accurate. This is where process and discipline come in.

1. Recording transactions

Every transaction should be recorded at the time it happens. Therefore, ask employees to submit receipts immediately, with the custodian logging the purchase under the correct expense category (e.g., transport, supplies, and client costs).

2. Reconciling and replenishing

At some point, the fund will need to be topped up. The process should always start with petty cash reconciliation. Compare receipts against the remaining cash on hand to confirm the numbers add up. If they don’t, investigate immediately, no matter how small the discrepancies are.

Best Practices for Managing Petty Cash

Regardless of how structured your petty cash management is, it never hurts to follow best practices to ensure the process runs smoothly for everyone involved.

1. Make policies simple and accessible

A policy is only effective if it’s easy to understand and follow. Ensure your petty cash guidelines are clear, visible, and accessible to all employees. You can include them in onboarding materials or post them near the petty cash fund or register.

By setting clear expectations from the start, employees are more likely to follow them, minimizing confusion and reducing the risk of mismanagement.

2. Track and analyze spending trends

While reviewing receipts is essential, it’s vital to look at spending trends over time. If you notice recurring purchases from petty cash, consider setting up an ongoing supplier account or creating a small budget line specifically for these expenses.

Keep petty cash reserved for truly unexpected or one-time purchases, and you won’t need to dip into it for regular costs.

3. Add accountability with digital tools

Pluto removes the burden of manually reviewing every transaction by automatically categorizing petty cash expenses. For example, if someone uses petty cash for stationery, Pluto’s OCR and AI will recognize the receipt and log the expense under office supplies.

Additionally, Pluto provides a complete audit trail for every transaction, enabling your finance team to trace the flow of money easily. Such visibility is critical, especially when multiple people are involved in handling petty cash.

For instance, if someone tries to spend beyond their budget or misclassifies a receipt, Pluto will alert the relevant manager for approval, preventing petty cash mistakes before they happen.

Reporting and Reconciling Petty Cash

When you reconcile petty cash, you are not only confirming balances but also gaining insight into how money is being used. By grouping expenses under business functions such as sales, client servicing, administration, or operations, you can see patterns that influence planning:

- Are client meeting costs consistently high?

- Are courier charges taking up more than expected?

- Should certain recurring items move into a dedicated budget line?

This turns reconciliation into a financial planning exercise instead of just a box-ticking process.

Petty Cash Log Template (Basic Example):

Why Pluto is a Better Alternative to Traditional Petty Cash

Pluto turns petty cash records into clear, visual reports. Instead of scanning rows of numbers, you see spending trends over time through line and bar charts.

You can spot recurring costs, like weekly courier runs or regular office supply purchases, and distinguish them from true one-off expenses.

The tool also flags unusual activity. Out-of-policy spending, sudden spikes, or misclassified expenses appear in the dashboard before reconciliation closes.

Modernize Petty Cash with Digital Tools

By now, you’ve seen how petty cash can either become a blind spot or a reliable support system. The difference lies in how it’s managed with clear policies, accurate logs, and consistent reconciliation.

Handled this way, petty cash is no longer just a cash drawer log full of notes and receipts. It becomes part of a healthier financial workflow, one that gives your team flexibility while keeping leadership in control.

Pluto strengthens that workflow by adding visibility and foresight. Instead of chasing paperwork, you can see where money is going, identify trends early, and keep spending aligned with company goals.

The result is less time on administration and more time for decisions that actually move the business forward. If you’re ready to simplify petty cash and bring it into the same modern process as the rest of your finances, book a demo with Pluto.

Frequently Asked Questions (FAQs)

1. How do you manage and track petty cash?

You manage petty cash by setting up a petty cash fund with a custodian and keeping a petty cash log of all withdrawals. Use receipts or vouchers to document each transaction. Digital petty cash tracking tools make the process faster, more accurate, and easier to manage.

2. What are the rules for petty cash?

Rules usually cover spending limits, approved expenses, and receipt requirements. A simple office petty cash policy helps prevent misuse. Many businesses also use a cash voucher system for withdrawals. These rules create accountability and make expense reporting and audits straightforward.

3. How do I reconcile petty cash transactions?

To reconcile petty cash, compare the receipts and the petty cash log against the actual money in the fund. Investigate any differences immediately. Regular petty cash reconciliation keeps records accurate, ensures accountability, and simplifies audit petty cash reviews when required.

4. What’s the best way to handle petty cash in a small business?

For small business cash management, keep the fund small, define a clear office petty cash policy, and update the petty cash log consistently. Use digital tools to streamline reimbursement and expense reporting. This saves time and makes it easier to reconcile petty cash regularly.

.png)

.png)