Accounts payable (AP) is the money you owe vendors and creditors, i.e., short-term liabilities. These are the payments for goods and services you received that are yet to be cleared.

Companies struggle to manage accounts payable because the process involves multiple stakeholders, and the workflow isn't clearly laid out. The teams have to handle hundreds of documents, including purchase requests, purchase orders, goods received notes (GRN), invoices, etc. and ensure there isn't any discrepancy with the order received.

So, decentralized approvals and verifications make the process chaotic before the team can clear the final payment. If you find yourself in a similar situation, where accounts payable is hectic, and the working capital is messed up, read this post to discover the top strategies for effective accounts payable management.

{{less-time-managing="/components"}}

What is the Account Payable Process?

The AP process starts upon receiving goods and an accompanying invoice for payment processing. The next step involves verifying the accuracy of the invoice details. This verification process ensures that the goods received match the information provided in the invoice, including quantities, prices, and other relevant terms.

Following the confirmation, the invoice undergoes an approval workflow. It involves obtaining the necessary authorizations from various departments or individuals within the organization and ensuring compliance with internal policies and procedures before proceeding with the payment.

After completing the payment, the accounts payable team records the transaction in the financial system, updating the company's records. This step ensures accurate financial reporting and maintains an up-to-date overview of the company's financial position.

Challenges of the Decentralized Accounts Payable Process

Companies strive to maintain a seamless flow of goods and services while meeting financial responsibilities through timely and accurate AP management. However, relying on a manual process for these tasks introduces these bottlenecks:

- Managing documents manually raises concerns, particularly with paper-based documents that are susceptible to misplacement or damage. It not only hampers day-to-day operational efficiency but also poses a threat to data integrity.

- Similarly, a manual verification process increases susceptibility to mistakes. Achieving precise alignment between received goods and invoice information requires meticulous attention, heightening the possibility of overlooking crucial details such as terms and conditions.

- The manual handling in the approval workflow introduces risks of delays and potential oversights. Obtaining authorizations from different departments becomes time-consuming, and ensuring compliance with internal policies is prone to human errors.

- After completing the payment, the critical step of recording the transaction in the financial system becomes vulnerable to manual data entry errors, impacting the precision of financial reporting and the clarity of the company's financial standing.

- The manual process increases the likelihood of inadvertently paying the same invoice multiple times. Inaccurate data entry and a lack of robust authentication processes expose the organization to fraud, including the manipulation of invoices.

In summary, the manual accounts payable process detrimentally affects operational efficiency and financial stability. The lack of synchronization across different teams results in communication gaps and discrepancies. Failing to maintain a cohesive and streamlined process leads to errors in financial reporting, impedes effective decision-making, and strains interdepartmental collaboration.

Strategies for Efficient Accounts Payable Management

Effective management of the accounts payable process is possible when you optimize the human and technological aspects of the same.

On the human side, optimizing requires streamlining workflows, enhancing communication, and fostering a collaborative environment. Simultaneously, the technological part involves shifting to an accounts payable automation solution that provides a centralized platform for complete visibility and control.

Here are the strategies for efficient accounts payable management:

Strengthen Internal Control Over Financial Reporting

Internal control over financial reporting (ICFR) ensures the accuracy, reliability, and integrity of financial information within an organization. ICFR helps safeguard financial processes and mitigate risks as the intricate nature of accounts payable necessitates a robust control framework.

Strengthening ICFR for enhancing accounts payable management involves the following elements:

1. Segregation of Duties

With the segregation of duties, you ensure that no single individual controls all the stages of the accounts payable process. You divide the responsibilities among different staff members, which reduces the risk of errors, fraud, and mismanagement.

For instance, by assigning one team member to handle invoice approval and another to process payments, the segregation of duties minimizes the risk of errors or fraudulent activities and promotes accountability.

2. Audit Trail

Establishing a comprehensive audit trail involves recording and documenting every transaction in a chronological sequence of activities. It facilitates transparency and serves as a valuable tool for tracking and investigating discrepancies that arise during the accounts payable process.

For instance, in the case of an invoice mismatch, a comprehensive audit trail makes it easy to trace the exact steps in the transaction history, revealing where the error occurred. It speeds up the resolution process and enhances accuracy in financial reporting by promptly addressing issues.

3. Approval Policies

Clearly defined approval policies outline the hierarchy of authorizations required for various transaction amounts, ensuring that financial transactions undergo proper scrutiny before processing.

For instance, a clearly defined approval policy mandates that transactions under $1,000 require approval from a department head, while amounts exceeding $10,000 necessitate approval from top-level management.

4. Document Policies and Procedures

Clear documentation outlines specific steps for the accounts payable process. When a team member adheres to these guidelines, all required approvals are obtained, documentation is consistently retained, and errors are minimized.

In practical terms, this means that during an audit, the organization quickly and accurately traces the entire lifecycle of an invoice, showcasing compliance, reducing audit time, and enhancing financial transparency.

By strengthening ICFR, organizations systematically address challenges such as fraud, errors, and inefficiencies.

Employing Technology

AP automation optimizes the accounts payable management process beyond mere operational enhancements, enabling accuracy, efficiency, and informed decision-making. Automating AP management is a strategic approach with the following key elements:

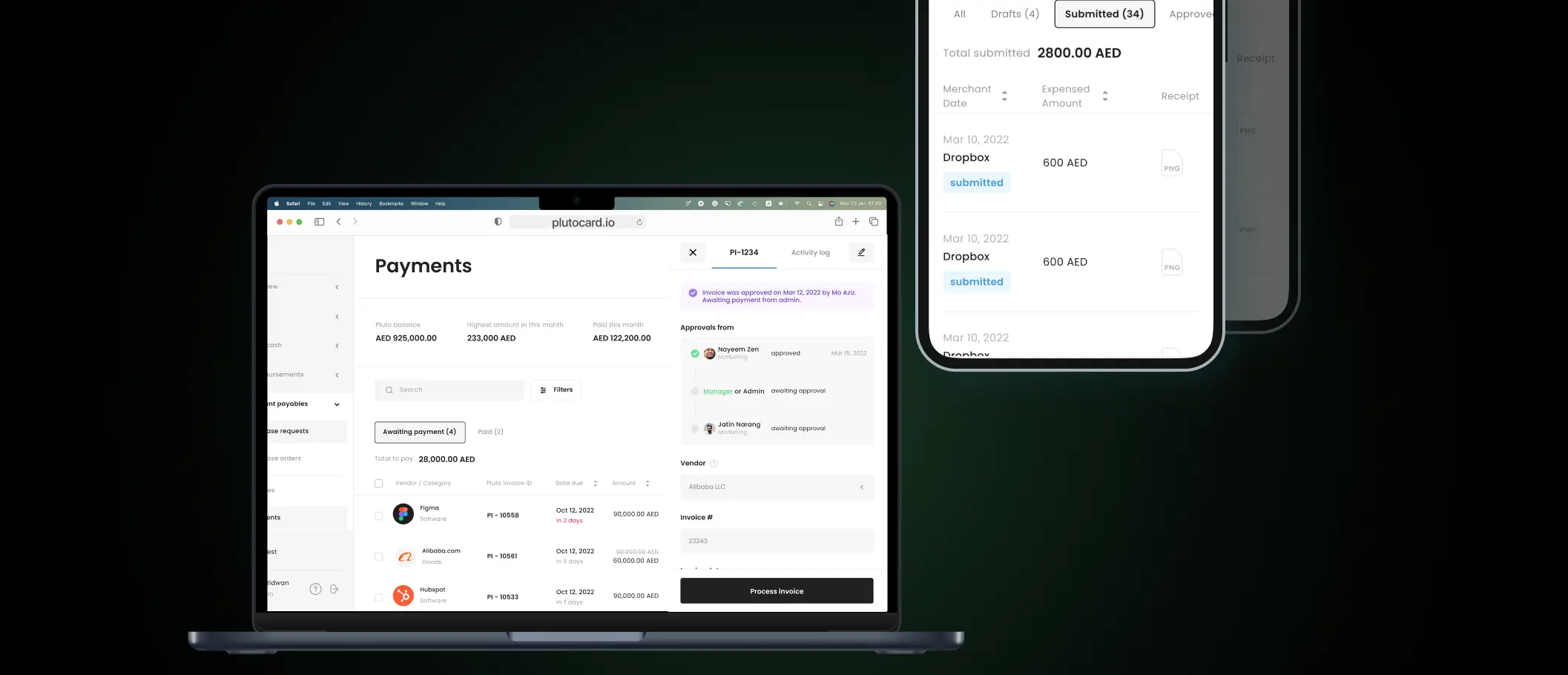

1. Centralized Collaboration

Automation involves centralizing AP management and creating a unified document storage and collaboration platform. Not only does it extract all the critical information, but it also stores them on a centralized dashboard for easy access and processing. This fosters seamless communication among team members, ensuring everyone can access real-time information and collaborate effectively.

2. Safeguards for Duplicate Payments

Automation includes built-in safeguards to prevent duplicate payments. Automated systems employ checks and validation processes to flag duplicate receipts and eliminate the risk of paying the same invoice multiple times, reducing the likelihood of financial errors. Moreover, since the centralized platform acts as a single source truth, the possibility of double payments automatically reduces.

3. Streamline Workflow

Automated workflows simplify and streamline the entire AP process. With simple if-then rules, you can create workflows for trigger-based approvals. By eliminating manual intervention at various stages, tasks such as invoice approval, payment processing, and data entry become more efficient, reducing processing times and enhancing overall workflow.

4. Integrate

The accounts payable software integrates with other financial systems. This integration ensures a cohesive flow of information across departments, reducing data silos and enhancing accuracy in financial reporting.

5. Insights

Automated AP systems provide valuable insights through analytics and reporting tools. These insights enable businesses to track key performance indicators, identify trends, and make data-driven decisions. This analytical capability contributes to strategic financial management and planning.

Improve Vendor Relationships

Vendor relationships are not just about successful transactions. Healthy partnerships bring many benefits, such as streamlined processes, minimized disruptions, and a collaborative atmosphere that enhances the overall effectiveness of the accounts payable function within the organization.

Improving accounts payable management involves the following components:

1. Negotiate With Vendors

Initiating negotiations with vendors involves engaging in open discussions about terms, pricing, and contractual agreements till both parties arrive at mutually beneficial arrangements. Compelling negotiation ensures favorable terms for the company and establishes a foundation of trust and collaboration.

For instance, when negotiating with a key supplier for raw materials, the company secures favorable terms such as bulk purchase discounts and extended payment periods. This not only reduces costs but also builds a positive, long-term relationship.

2. Timely Payments

Adhering to agreed-upon payment schedules fosters goodwill and reliability, positioning the company as a trusted and preferred partner. Timely payments strengthen vendor relationships and contribute to smoother transactions and potential benefits such as early payment discounts.

3. Transparent Communication

Keeping vendors informed about payment timelines, potential delays, or any changes in the process contributes to a positive working dynamic. Open lines of communication facilitate problem-solving, creating an environment where both parties feel comfortable addressing concerns and finding resolutions.

4. Streamline Onboarding Process

Simplifying the onboarding procedure by providing clear guidelines, efficient documentation processes, and transparent communication ensures that vendors can seamlessly integrate into the accounts payable system. It saves time and lays the groundwork for a cooperative and efficient long-term partnership.

By implementing these strategies, businesses cultivate vendor relationships that go beyond transactional interactions, fostering a collaborative environment.

End Result: Optimized Accounts Payable Management Process

For storing and retrieving documents, you get optical character recognition (OCR) technology that extracts invoice information accurately. All the information goes on a centralized digital platform, reducing the chance of misplacement and improving accessibility.

For verification, you get all the necessary information on a unified dashboard. This centralized database enables accurate cross-referencing of received goods with invoice details, minimizing errors and making the process more efficient.

You get a no-code trigger-based approval workflow builder for approvals, where you can create workflows with simple if-then rules. These preset rules and automated notifications make authorization seamless across departments, reducing delays, ensuring policy compliance, and lowering the risk of human errors.

For recording transactions, you get integration facilities, where your accounts payable software syncs data across your accounting systems for consistent records, minimizes errors, ensures precise financial reporting, and offers a real-time, accurate view of the company's finances.

Next Steps for Efficient Accounts Payable Management

After establishing transparent processes and policies and adopting the right automation tools, plan an AP audit.

An AP audit involves reviewing and assessing the existing procedures to pinpoint areas that can be improved. By doing so, you identify inefficiencies or bottlenecks in the accounts payable management system. It provides insights into how well the established processes align with the intended goals and whether adjustments are needed.

This proactive approach helps enhance the overall efficiency and effectiveness of accounts payable management, ensuring that the system operates smoothly and aligns with the company's objectives.

Read more about AP audits in our post to understand how they help and how you can prepare for them in advance.

.png)

.png)